Now Reading: New Earnings Tax Invoice 2025 defined: Prime 30 FAQs each taxpayer ought to examine

-

01

New Earnings Tax Invoice 2025 defined: Prime 30 FAQs each taxpayer ought to examine

New Earnings Tax Invoice 2025 defined: Prime 30 FAQs each taxpayer ought to examine

New Earnings Tax Invoice 2025: Finance Minister Nirmala Sitharaman launched the New Earnings Tax Invoice 2025 in Lok Sabha earlier this week. The New Earnings Tax Invoice is predicted to exchange the many years previous Earnings Tax Act 1961. It’s easier and simpler for the taxpayer to grasp, says the federal government. The federal government has launched a listing of prime 30 FAQs that taxpayers could have in regards to the New Earnings Tax Invoice 2025. We have a look:

New Earnings Tax Invoice 2025: Prime 30 FAQs Answered

1. When was the present Earnings-tax Act handed?

The present Earnings-tax Act was enacted in 1961 and got here into existence with impact from 01.04.1962. It has been amended practically 65 occasions with greater than 4000 amendments, 12 months on 12 months via Finance Acts, primarily based on the evolving necessities of modifications in taxation Coverage.

Additionally Learn | New Earnings Tax Invoice 2025: Learn full textual content of proposed new I-T Act

2. What issues have been raised relating to the Earnings-tax Act 1961?

Tax directors, practitioners and taxpayers have acknowledged the contribution of

the Earnings-tax Act, 1961 in general tax governance and financial system. Nonetheless, over the time issues have additionally been expressed over the buildup of amendments, the intricate language, detailed provisions, redundancies and the heavy construction of the Earnings-tax Act.

3. What are the explanations for normal amendments within the Earnings Tax Act as in opposition to different Acts?

The Earnings-tax Act is dynamic laws requiring common updating and amendments to replicate the nation’s altering financial, social, and political realities. Legal and different civil legal guidelines don’t endure such frequent updating and amendments whereas the Earnings-tax Act is often up to date (on annual foundation) to replicate the financial adjustments, fiscal insurance policies, and authorities priorities. It, due to this fact, adapts to adjustments within the financial system, enterprise environments, inflation charges, earnings sources, and world monetary developments. The federal government has launched tax reforms to encourage particular sectors of the financial system whereas balancing the identical with necessities of income assortment and widening/deepening of the tax base. Given its direct hyperlink to taxation and financial situations, the Act must be extra adaptable to replicate shifting financial insurance policies, altering incomes, inflation, and rising industries. The dynamic nature of the Earnings-tax Act gives it flexibility to accommodate new financial developments.

Examples:

i. To advertise exports, particular provisions akin to 80HH, 80HHC had been introduced into the statute. The identical having served meant function have been since omitted or made inapplicable after solar set date.

ii. To advertise infrastructure improvement, part 80IA was introduced into Earnings-tax Act, 1961.

iii. Sections 80HHE, 10A and 10AA had been launched for facilitating software program exports.

iv. Part 80IAC is yet one more instance of encouraging the start-ups.

4. Why has the Earnings-tax Act 1961, grow to be cumbersome over time?

The earnings tax legislation has grow to be more and more cumbersome over time, with its conventional fashion of drafting and quite a few amendments. The complexity of language within the current Act is a product of various components. To maintain tempo with sure authorized pronouncements, explanations and provisos had been typically inserted to make clear legislative intent. Altering taxation priorities additionally led to introduction of extra textual content to an in any other case easy provision. Additional, sure provisions remained within the statute, regardless of turning into non-operational, in view of pending claims/points from earlier years.

5. What simplification efforts have been made up to now?

Makes an attempt have been made up to now, together with these in 2009 and 2019 for simplification of the Earnings tax Act. The suggestions from these efforts, as regards coverage, have been thought of within the amendments carried out every now and then.

6. Has the current simplification train thought of worldwide expertise of different international locations who’ve undertaken related train?

Simplification of tax legal guidelines has acquired consideration globally. Nations have undertaken related workout routines to boost readability and compliance of their taxation legal guidelines. Within the UK, the method was carried out through the interval 1994 to 2010 for simplifying the language. Earlier than simplification, the UK Earnings and Company Tax Act, 1988 comprised 960 pages. Nonetheless, after simplification, it was divided into 5 separate Acts, with their web page counts elevated, leading to a extra segmented however general bigger physique of tax legislation.

Additionally Learn | New Earnings Tax Invoice 2025 defined: 10 key takeaways for taxpayers – prime factors you must know

Equally, Australia underwent an analogous course of throughout 1994 to 1997, the place simplification of language additionally resulted in an extended tax code.

These worldwide experiences emphasize the fragile steadiness between simplification and the necessity for clear, unambiguous authorized language. Drawing from these classes, effort has been made to focus not simply on linguistic simplification but additionally on structural rationalization.

7. What’s the scope of train undertaken for the brand new Earnings-tax Invoice?

The Hon’ble Finance Minister within the price range speech in July 2024 acknowledged that the aim of the great evaluation of the Earnings-tax Act, 1961, is to make the Act “concise, lucid, simple to learn and perceive”.

8. What floor guidelines are set for making the present provisions concise, lucid, simple to learn and perceive?

Following floor guidelines have been thought of for simplifying the present provisions:

i. The Invoice proposes to remove redundant provisions, decreasing its size by practically half.

ii. The drafting fashion of the brand new Invoice is easy and clear, making the provisions simpler to grasp by incorporating greater than 57 tables in comparison with 18 tables within the Earnings-tax Act, 1961. Sub-sections and clauses have been used, as an alternative of counting on provisos and explanations for exceptions and carve-outs. This minimises cross references and battle by aggregating all relevant provisions associated to a single state of affairs in a single place.

iii. All provisos (about 1200) and explanations (about 900) have been eliminated.

iv. The 1961 Act incorporates quite a few cross-references to sections, sub-sections, clauses, sub-clauses, objects, and sub-items, making the provisions difficult to interpret. The brand new Invoice adopts a simplified reference system, permitting provisions to be cited by merely mentioning the part. As an example, part 133 (1)(b)(ii) within the new invoice would point out sub-clause (ii) of clause (b) of sub-section (1) of part 133 within the current Act. This transformation makes the Act’s language simpler to grasp.

v. A big side of the Invoice is the elimination of the ideas of ‘earlier 12 months’ and ‘evaluation 12 months’. Previous to 1989, the idea of ‘earlier 12 months’ and ‘evaluation 12 months’ had been introduced as a result of the taxpayers may have totally different twelve-month earlier years for every supply of earnings. From 1st April 1989, earlier 12 months was aligned to a monetary 12 months in all instances. Nonetheless, ‘evaluation 12 months’ continued for use for numerous proceedings beneath the Act. Thus, a taxpayer was required to trace two totally different intervals, i.e., the ‘earlier 12 months’ in addition to the ‘evaluation 12 months’. This introduced difficulties in complying to the provisions of the Act particularly for a brand new taxpayer who needed to maintain monitor of ‘earlier 12 months’, ‘evaluation 12 months’ in addition to ‘monetary 12 months’.

Additionally Learn | Earnings Tax Slabs FY 2025-26 defined: 20 FAQs particular person taxpayers ought to examine to grasp tax charges, earnings tax profit beneath new tax regime

9. Whether or not any consultations have been accomplished with stakeholders, whereas drafting new Invoice?

A complete consultative course of was undertaken for the simplification train. A complete of 20,976 on-line recommendations for simplification and removing of redundancies had been acquired, analysed and related recommendations had been categorized into policy-related, language simplification, removing of redundant or out of date provisions, and so forth. Conferences with business {and professional} associations had been held and field-level brainstorming periods had been held throughout the Earnings Tax Division, in the direction of this train.

On the worldwide stage, consultations had been held with among the taxation authorities that had undertaken related train within the latest previous, viz. the Australian Tax Workplace and Treasury, and the UK’s Workplace of Tax Simplification.

The paperwork ready in 2009 and 2019, had been additionally referred, whereas enterprise the train. Worldwide and nationwide steering materials akin to ‘Drafting Information for Simplification of Legal guidelines’ issued by Legislative Division, Ministry of Legislation and Justice, was studied for simplification of authorized language.

10. What processes had been adopted in conducting the simplification train?

Along with the stakeholder train talked about in Q I.9, recommendations had been sought from taxpayers, business {and professional} associations, and area stage officers of the Division. A committee of round 150 officers of the Division was actively concerned in all the train. The Committee ready the draft textual content of varied chapters, which was meticulously vetted by the Legislative Division of Ministry of Legislation and Justice, and consolidated within the type of the ultimate Invoice, after needed approvals.

Greater than 60,000 man-hours had been devoted by the group for finalising the brand new Invoice.

11. How has the readability improved within the new Invoice?

The readability of tax legislation has been improved by utilizing easier language, as in opposition to conventional authorized language. The place a number of conditions are coated, the sections have been made enumerative. Wherever possible, intensive use of desk codecs has been made. TDS provisions have been introduced in a tabular type. Sure provisions akin to part 10, which contained about 150 clauses has been positioned in Schedules and introduced within the type of tables.

On account of the great train, the dimensions of the brand new Invoice has diminished by about half on one hand and one the opposite, the provisions have been consolidated and introduced in a consumer pleasant format.

12. What’s the therapy of quite a few ‘provisos’ and ‘explanations’ and procedural features within the current Act?

Provisos (greater than 1200) and Explanations (greater than 900) have been eliminated, with their simplified content material positioned as sub-sections or clauses. Wherever possible, procedural features and particular particulars are proposed to be offered by the use of Guidelines.

13. Have the redundant provisions of the Earnings-tax Act 1961 been eliminated within the new Earnings-tax Invoice?

Sure. Sure provisions turned redundant as a consequence of quite a few amendments and/or coverage adjustments through the years. This resulted in giant variety of such provisions within the Act. For instance, deduction beneath part 10A, which was a particular provision for newly established industrial undertakings within the free commerce zones, is now not accessible from the Evaluation 12 months 2012-13, onwards. Such out of date provisions have been faraway from the textual content of the Invoice.

Nonetheless, provisions relevant to earlier Evaluation Years shall be ruled by Repeal and Financial savings provisions.

14. What different steps have been taken to boost readability within the new Invoice?

Along with removing of ‘provisos’, ‘rationalization’ and redundant provisions, formulae, tables, and buildings have been used to boost readability within the new invoice. To the extent doable, provisions involving the identical points, which had been current in several chapters within the present Act, have now been consolidated. Redundancy has been eliminated and definitions at a number of locations have been consolidated.

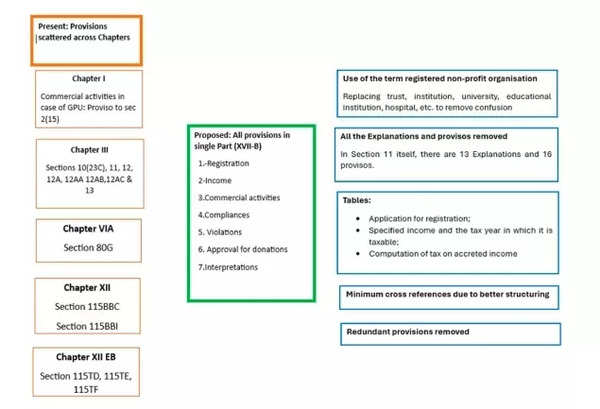

In case of provisions regarding Non-Revenue organisations (NPOs), all the textual content associated to NPOs has been consolidated and structured into 7 sub-parts which include provisions associated to Registration, Earnings, Industrial actions, Compliances, Violations, Registrations for the needs of eligibility of donations and Interpretations.

15. How have rules of Tax Certainty adopted in drafting of the brand new Earnings Tax Invoice?

The brand new Earnings-tax Invoice is roughly half the size of the present Earnings-tax Act 1961, with important re-organisation of provisions in several sections. Whereas enterprise simplification train, a acutely aware try has been made to minimise the scope of litigation and contemporary interpretations. For this function:

a. Key phrases/phrases, particularly the place courts have given rulings, have been retained with minimal modifications.

b. Language has been simplified by use of brief sentences to the extent doable.

c. Sections have been translated into row or sub-rows in tables, decreasing the variety of phrases and bringing readability.

d. Provisions have been made clear to reduce scope for a number of interpretations. The provisos and explanations have been eliminated and simplified content material has been positioned as sub-sections and clauses.

e. Provisions associated to worldwide taxation have been handled, broadly, to make sure tax certainty.

f. NGO chapter has been made extra complete with use of plain language.

g. Exemption sections, for instance part 10 within the current Act, has been made easier via tables and inserting giant variety of provisions in Schedules.

h. Formulae and tables have been used to boost readability, wherever possible.

i. Provisions involving similar points and definitions, which had been current in several chapters within the current Act have been consolidated, to the extent doable.

Additionally Learn | Newest earnings tax slabs 2025-26: How a lot tax do people incomes barely above Rs 12 lakh should pay? Marginal reduction calculations defined

16. How does the brand new Invoice examine to the Earnings-tax Act, 1961 by way of numbers of Chapters, sections and phrases?

There was a big discount within the textual content of latest Invoice, compared to the present Earnings Tax Act, as summarised beneath.

* Efficient Sections

Moreover about 1200 Provisos and 900 Explanations have been eliminated.

17. What’s the foundation of the assertion that the Earnings tax Act, 1961 consists of 819 sections, whereas the textual content of the Act solely mentions sections until 298?

In the course of the course of quite a few amendments to the Earnings tax Act, 1961, a number of coverage choices had been integrated as separate provisions. Many a occasions such provisions had been related to already current sections and accordingly the brand new sections had been numbered in continuation to the present sections. For instance, a number of provisions regarding tax on particular instances had been inserted as sections beginning with 115 sequence viz 115 AC,115AD, 115JB, 115VP and so forth.

On account of such insertions, efficient sections current within the Earnings tax Act, 1961 are 819.

18. Why does the brand new Invoice nonetheless include 536 sections and a pair of.6 lakh phrases?

Whereas the present Earnings-tax Act incorporates 298 numbered sections, efficient sections within the present Act are 819. It is because aside from numeric part numbers there are giant variety of sections with alpha-numeric codes akin to 115A to 115WM (117 sections) and so forth. The Earnings-tax Act not solely offers with levy of tax however it’s a complete doc, which encompasses all features of tax administration. It additionally consists of different features akin to:

(a) laying down the executive framework, assigning roles and duties for assessing officers, taxpayers, tax deductors, and professionals and so forth;

(b) setting out the framework for earnings dedication, timelines, appellate procedures, enforcement, assessments, and penalties; and

(c) bearing in mind the influence of interpretations on financial coverage, affecting each home and worldwide investments.

The brand new Invoice proposes 536 sections to fulfill the above-mentioned necessities.

Additional, a number of sections within the new Invoice exist primarily to honour the commitments beneath the present tax regime, together with provisions regarding Minimal Alternate Tax (MAT), numerous deductions and exemptions, and so forth. These provisions will stay in pressure till their respective sundown clauses take impact. Subsequently, these are required to be a part of new Invoice to make sure a clean transition, whereas sustaining authorized and coverage continuity.

19. Whether or not the simplification train has led to no ‘materials’ change?

The simplification train, inter-alia, encompasses following features:

i. Redundant provisions of the Earnings tax Act have been eliminated;

ii. Sub-sections and clauses have been used, as an alternative of counting on provisos and explanations for exceptions and carve-outs;

iii. Simplified system for cross referencing of sections, sub-sections, clauses and so forth has been used;

iv. Intensive use of tables, formulae for enhanced readability;

v. Consolidation of provisions scattered throughout numerous sections/ Chapters regarding a single difficulty; and so forth

Since there have been common amendments to the Earnings Tax Act, 1961 together with amendments proposed in Finance Invoice, 2025, the Act stands up to date from coverage perspective. All amendments proposed upto Finance Invoice 2025 have been duly integrated within the new Earnings tax invoice 2025. Subsequently, whereas no main coverage associated adjustments have been made within the Invoice, the above features have led to proposed ‘materials’ adjustments within the current legislation.

20. Whether or not any mapping of previous and new sections can be accessible?

Part-wise mapping can be made accessible on the official web site of the Earnings Tax Division.

21. How has ‘earlier 12 months’ and ‘evaluation 12 months’ been handled within the new invoice?

The idea of ‘tax 12 months’ has been launched changing ‘earlier 12 months’ and ‘evaluation 12 months’. The timelines and computation within the Invoice are actually as regards to the monetary 12 months for which the earnings is liable to be taxed. It’s anticipated that the usage of ‘tax 12 months’ will make the brand new Invoice simpler to grasp. Additional, most of the comparable tax jurisdictions on the earth are utilizing one single time period, for function of denoting the unit interval of taxation. ‘Tax 12 months’ is often utilized in many international locations.

With the introduction of ‘tax 12 months’, broadly the next rules have been adopted:

i. ‘Tax 12 months’: Unit interval of taxation. This time period shall be referred in respect of all transactions and earnings for that interval.

ii. ‘Monetary 12 months’: For functions of timelines for compliance and for procedural points.

Additionally Learn | Finances 2025 Earnings Tax calculator defined: Save as much as Rs 1.1 lakh! How earnings tax slab adjustments will profit taxpayers at totally different wage ranges beneath new regime

22. How have the provisions of TDS and TCS been simplified within the new invoice?

TDS and TCS provisions have been made simpler to grasp by offering tables. There are separate tables for cost to residents and non-residents, and the place no deduction at supply is required. For instance, the proposed provisions regarding TDS on hire are proven beneath:

(Reference might be made to Desk in proposed part 393 of the Invoice)

23. What has been accomplished to simplify the provisions associated to Non-Revenue Organizations?

The provisions associated to Non-Revenue Organizations had been current at totally different locations within the current Act, in part 11, part 12, part 12A, part 12AA, part 12AB, part 13, part 115BBC, part 115BBI, part 115TD, part 115TE, part 115TF. The provisions associated to approval are beneath the primary and second proviso to part 80G (5). These have been simplified and consolidated into one chapter. All of the provisions associated to registered Non-Revenue Organisations have now been organized in Half B of Chapter XVII titled “B.–– Particular Provisions for Registered Non-Revenue Organisation” within the new Invoice.

Particular Provisions for Registered Non-Revenue Organisation

24. What simplification has been carried out for salaried staff within the new invoice?

All of the provisions pertaining to wage have been consolidated at one place for ease of understanding in order that the taxpayer doesn’t should consult with separate chapters for submitting his return of earnings. The deductions which had been earlier allowed beneath part 10 of the Earnings Tax Act,1961, like gratuity, depart encashment, commutation of pension, compensation on VRS and retrenchment compensation, are actually a part of the wage chapter itself. A few of the allowances like HRA are actually offered in Schedule II of the brand new Invoice that finds reference within the provisions regarding wage. The target was to enhance readability by the use of offering tables and formulation.

Whereas the chargeability of all of the perquisites has been retained within the Act, their valuation, situations and exceptions have been shifted to Guidelines as they don’t have an effect on each taxpayer. Equally, redundant and repetitive provisions have additionally been eliminated for higher readability.

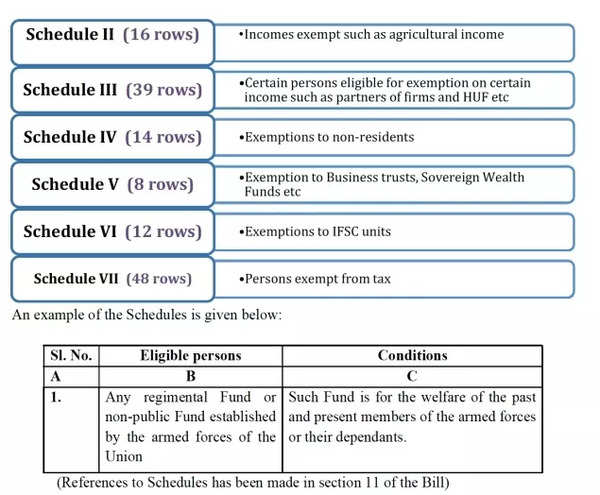

25. What adjustments are being made to exemptions for particular incomes and individuals?

Provisions regarding exemptions for particular incomes and individuals are being moved to separate schedules for simpler reference and easier compliance as follows:

Schedules

26. What are the subsequent steps after the brand new Invoice is launched?

Stage 1: Invoice is handed by the Parliament and turns into an Act

Stage 2: Operational and delegated laws framework

i. Notification of latest Guidelines and Varieties.

ii. Simultaneous train of software program improvement to arrange the techniques and processes for numerous administrative and quasi-judicial capabilities.

27. How will the previous and new provisions co-exist?

Varied aspects of compliance for the respective years have been talked about within the Repeals and Financial savings clause within the Invoice, which can safeguard all rights and liabilities accrued beneath the previous legislation.

28. What are the adjustments on charges and different coverage within the new invoice?

There aren’t any adjustments associated to charges. Since there have been common amendments to the Earnings Tax Act, 1961 together with amendments proposed in Finance Invoice, 2025, the Act stands up to date from coverage perspective. All amendments proposed upto Finance Invoice 2025 have been duly integrated within the new Earnings tax invoice 2025. Subsequently, whereas no main coverage associated adjustments have been made within the Invoice, the above features have led to proposed ‘materials’ adjustments within the current legislation.

29. Why is it that on comparability of latest Earnings Tax Invoice and earlier provisions, it’s discovered that in some instances viz ‘digital digital belongings’, and so forth there are specific adjustments?

The Earnings Tax Invoice 2025 additionally incorporates all amendments proposed in Finance Invoice 2025. Subsequently, the customers are suggested to check the provisions of the Earnings Tax Act, 1961, as up to date with proposed amendments in Finance invoice 2025, whereas studying the Earnings Tax Invoice, 2025. There’s, due to this fact, no change within the scope of ‘digital digital asset’ beneath the Earnings Tax Invoice, 2025. The definition beneath the Invoice incorporates the modification already proposed beneath the Finance Invoice, 2025.

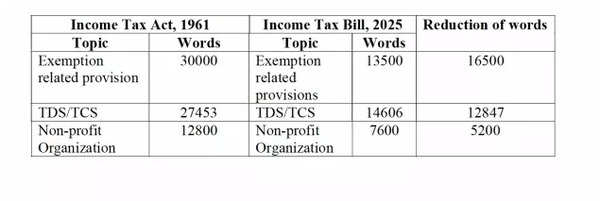

30. Which Chapters of the Earnings tax Act, 1961 have seen giant discount of phrases, on account of the simplification train?

As famous above, the overall phrases within the new Earnings Tax Invoice, 2025 are round 2.6 lakhs, as in opposition to 5.12 lakh phrases within the Earnings Tax Act, 1961. A few of the Chapters the place substantial discount of phrases have been achieved are as given beneath:

Discount of phrases