Now Reading: Trump’s tariff gambit: How it’s reshaping India, China, and the global economy

-

01

Trump’s tariff gambit: How it’s reshaping India, China, and the global economy

Trump’s tariff gambit: How it’s reshaping India, China, and the global economy

US President Donald Trump is escalating his global commerce struggle, focusing on not simply China but additionally allies like India. As a part of his “America First” financial technique, Trump introduced that India will face reciprocal tariffs beginning April 2, claiming that the nation imposes a few of the highest duties on US items.

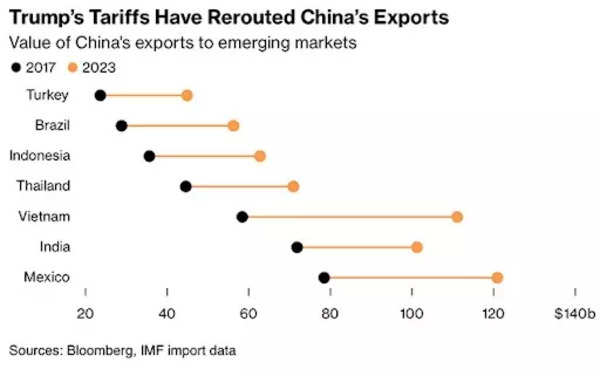

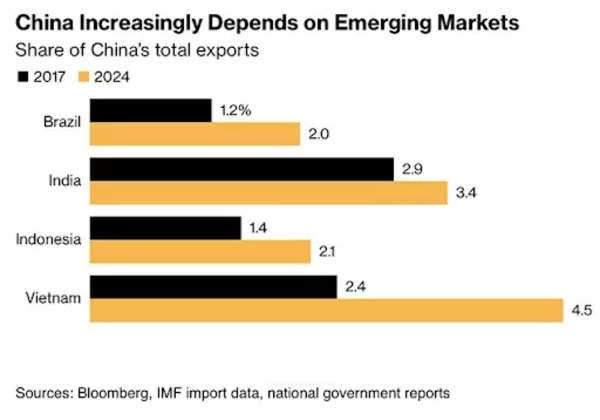

Meanwhile, his crackdown on Beijing is triggering a brand new “China Shock,” as extra Chinese exports flood global markets, disrupting industries and destroying jobs worldwide, a Bloomberg report mentioned. The world’s largest exporter, dealing with elevated commerce obstacles in the US, is flooding different markets with low cost items—undercutting native producers and eliminating jobs from Mexico to Indonesia to India.

Driving the information

In an interview with Breitbart News, Trump mentioned that whereas India is a “wonderful nation,” it has tariffs which are unfair to the US. “I have a very good relationship with India, but the only problem I have is they’re one of the highest tariffing nations in the world,” he mentioned. “I believe they’re going to probably be lowering those tariffs substantially, but on April 2, we will be charging them the same tariffs they charge us.”

.

On China, Trump is taking an much more aggressive stance, arguing that Beijing’s financial enlargement is hurting American employees and destabilizing industries worldwide. His newest tariffs are designed to curb China’s affect, however they’re additionally inflicting widespread disruptions in different economies that depend on commerce with China.

The financial fallout is already seen in Southeast Asia, the place Chinese exports—redirected from the US attributable to tariffs—are undercutting native companies.

Why it issues

Trump’s tariff struggle isn’t just a US-China showdown—it’s reshaping global commerce patterns, forcing nations like India to make robust selections and wreaking havoc on rising markets:

India’s dilemma: While Prime Minister Narendra Modi has cultivated sturdy ties with Trump, India is scrambling to cut back commerce tensions. In latest weeks, it has lowered duties on bourbon, high-end bikes, and sure agricultural items. More tariff reductions might observe as Indian officers work to keep away from a full-scale commerce struggle with the US.

China’s overflow downside: With US import obstacles rising, Chinese producers are aggressively searching for new markets. The outcome? An oversupply of Chinese items in nations like Indonesia, Mexico, and Brazil, placing strain on native producers.

A global financial danger: Trump’s tariffs have already rattled markets. As April 2 approaches, uncertainty is rising, with traders apprehensive about inflation and provide chain disruptions. Federal Reserve Chair Jerome Powell lately famous, “Uncertainty is remarkably high.”

New ‘China Shock’: India, others in crosshairs

- Trump’s commerce struggle can be fueling a second wave of the “China Shock,” a time period utilized by economists to explain the huge financial disruption attributable to China’s rise as a producing powerhouse in the early 2000s. Now, as Trump closes the door on Chinese imports, these merchandise are flooding global markets—resulting in financial misery in nations from Indonesia to Mexico.

- India in the crosshairs: India is feeling the warmth. Authorities in New Delhi have launched anti-dumping probes into a variety of Chinese merchandise, together with photo voltaic cells and cell phone parts, to protect home industries. Meanwhile, native textile producers are struggling to compete towards a flood of cheap Chinese clothes.

- The state of affairs in India mirrors what is occurring in Mexico and Southeast Asia. As per the Bloomberg report, in Mexico, President Claudia Sheinbaum has linked rising violence in industrial areas to mass layoffs attributable to the inflow of Chinese items. “So much of the entry of Chinese products into Mexico caused this industry to fall in our country,” Sheinbaum mentioned.

- Indonesia’s textile and attire business has shed round 250,000 jobs over the previous two years, with a further 500,000 positions projected to be in danger by 2025. This development would quantity to shedding roughly one in 4 business jobs inside only a few years. The tempo of those job losses surpasses the so-called “China Shock,” throughout which the US misplaced as many as 2.4 million jobs between 1999 and 2011.

- Thailand has imposed a value-added tax on low-cost Chinese imports. Sanan Angubolkul, the head of Thailand’s Chamber of Commerce, warned that the state of affairs is “very critical, and there’s no time to waste” as the nation offers with a surge {of electrical} home equipment, clothes and different Chinese items, the Bloomberg report mentioned .

- Vietnam has ordered Chinese e-commerce giants to droop operations.

- In Indonesia, garment producers are struggling to compete with low cost Chinese textiles. The Indonesia Fiber and Filament Yarn Producer Association estimates that one in 4 jobs in the sector might disappear this 12 months.

What they’re saying

- Trump’s newest commerce strikes have sparked sturdy reactions from enterprise leaders, economists, and authorities officers:

- Donald Trump, on commerce negotiations: “We have a powerful group of partners in trade. Again, we can’t let those partners treat us badly… The ones that wouldn’t be as friendly to us in some cases treat us better than the ones that are supposed to be friendly.”

- Howard Lutnick, US commerce Ssecretary: “These policies are the most important thing America has ever had… It is worth it.”

- Henrietta Treyz, financial analyst: “Markets remain skittish because this isn’t just about China anymore. Trump’s April 2 tariffs will hit everyone.”

- Brian Coulton, Fitch chief economist: “Tariff hikes will result in higher US consumer prices, reduce real wages, and increase companies’ costs.”

- “This is China Shock 2.0 or China Shock 3.0. China has this immense manufacturing capacity, and the goods have to go somewhere” Gordon Hanson, a professor of city coverage at the Harvard Kennedy School, advised Bloomberg.

Zoom In: India’s commerce battle

- India, which is each a competitor and a associate to China, faces distinctive challenges on this commerce struggle:

- The nation’s automotive, chemical, and electronics sectors have benefited from Trump’s tariffs on China, as US companies search different suppliers.

- However, India additionally imports closely from China, that means that any commerce obstacles on Chinese items might increase prices for Indian producers.

- Trump’s demand for reciprocal tariffs places India in a tough place. If India refuses, it dangers shedding entry to the profitable US market. But if it complies, home industries—particularly agriculture and small companies—might endure.

What’s subsequent

- As the April 2 tariff deadline approaches, a number of key developments might form the final result:

- India’s concessions: The Modi authorities is in talks to decrease extra tariffs, nevertheless it stays unclear if these strikes can be sufficient to fulfill Trump.

- China’s retaliation: If China feels additional cornered, it might step up its commerce offensive, worsening the financial fallout for different nations.

- Global recession fears: Economists warn that escalating commerce tensions might push the world nearer to a recession, with inflation rising and funding slowing.

The backside line

Trump’s tariff struggle is reshaping the global financial order. India is attempting to navigate a fragile stability, China is flooding markets with low cost items, and creating nations are dealing with a recent wave of job losses. With April 2 looming, the world is watching to see whether or not Trump’s hardball ways will succeed—or whether or not they’ll set off an excellent greater financial disaster.

(With inputs from businesses)