Now Reading: Russia oil sanctions: EU moves on crude, oil price cap may hit Reliance, Nayara; enforcing may be tough, India may still benefit

-

01

Russia oil sanctions: EU moves on crude, oil price cap may hit Reliance, Nayara; enforcing may be tough, India may still benefit

Russia oil sanctions: EU moves on crude, oil price cap may hit Reliance, Nayara; enforcing may be tough, India may still benefit

Russia oil sanctions impression: Both Nayara Energy and Reliance Industries Limited (RIL) are prone to face challenges from the recent sanctions imposed by the European Union on Russia oil.The EU launched its 18th sanctions bundle on Friday, decreasing the Russian oil price ceiling to $47.6 per barrel from the present $60, while additionally implementing measures towards vessels concerned in its transportation. The revised price cap takes impact September 3.While EU’s sanctions focusing on Nayara Energy current important operational difficulties for the corporate, the restrictions on Russian oil-derived fuels create a problem for RIL, in line with an ET report.Also Read | Russia oil squeeze: Trump’s 100% tariff menace – ought to India panic?Both Nayara and RIL now confront doable exclusion from EU markets, in line with trade consultants and analysts. These developments moreover hinder Rosneft‘s reported intentions to promote its 49% possession in Nayara. Both RIL and Nayara are India’s main gasoline exporters.

EU sanctions on Russia: Challenges for RIL

RIL, which maintains a long-term settlement to buy appreciable quantities of crude from Rosneft, presently faces a important determination: abandon entry to discounted Russian oil provides or lose entry to Europe’s worthwhile diesel market. Either selection would doubtless have an effect on the corporate’s refining revenue margins.Reliance, which has traditionally discovered Europe to be its most profitable marketplace for refined gasoline exports, may face challenges. Industry specialists counsel that enforcing import restrictions might show difficult for the EU, as Indian refiners usually work by means of buying and selling intermediaries quite than dealing instantly with European clients.

EU sanctions on Russia: How Nayara Will Be Hit

The European Union has imposed complete sanctions towards Nayara Energy, together with organisations managing shadow fleet vessels and people concerned in Russian oil commerce.An trade professional informed the monetary each day that Nayara might face difficulties with banking transactions, significantly with European-linked banks. The professional additionally highlighted potential challenges in accessing essential European technical help for refinery operations, while acknowledging doable various options.

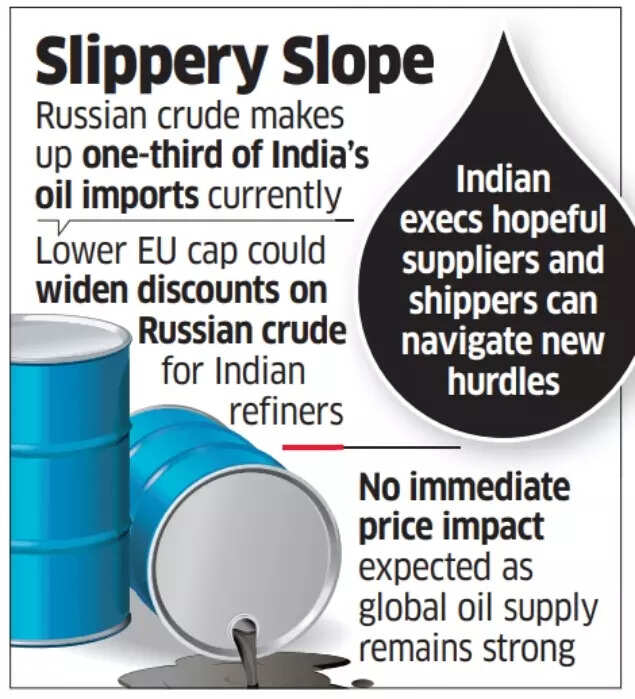

Slippery Slope

The sanctions stop Nayara from promoting refined merchandise to Europe.

Sanctions: Can They Be Implemented?

- The European Union faces difficulties in implementing the price cap with out US help. Oil transactions being denominated in {dollars} and processed by means of American monetary methods give the United States important management over enforcing violations of any caps.

- Although the United States has not endorsed the European Union’s initiative, it’s independently rising strain by proposing a 100% secondary tariff on Russia till it negotiates peace with Ukraine.

- Industry sources indicated that the EU’s determination was perceived as inconsistent, noting that European nations dependent on Rosneft would doubtless have secured various provide preparations earlier than implementing this measure.

Indian Government’s Stance

An trade consultant indicated these issues require governmental intervention. The Indian authorities has opposed the sanctions, emphasising the precedence of vitality safety.Also Read | India to tie-up with France for next-generation fighter jet engine? Defence Ministry pitches Rs 61,000 crore mission; key step in direction of self-reliance“India maintains its position against unilateral sanctions,” acknowledged Ministry of External Affairs (MEA) spokesperson Randhir Jaiswal on Friday. “As a responsible nation, we remain devoted to our legal commitments. The Government of India prioritises energy security as crucial for meeting our citizens’ essential requirements. We emphasise the need for consistent standards regarding energy commerce.”Officials mentioned that the European Union’s determination appeared inconsistent, noting that European nations dependent on Rosneft ought to have secured various provides earlier than implementing such measures.The MEA had beforehand addressed “double standards” on Thursday, responding to the North Atlantic Treaty Organisation (NATO) secretary common’s ideas of potential secondary sanctions on India for persevering with commerce relations with Russia.

Advantage India As Well

The EU carried out on Friday “an automatic and dynamic mechanism to modify the oil price cap” to keep up costs constantly beneath market charges, not like the earlier two years when the $60 cap often exceeded market values. “For India, this should enhance the appeal of Russian oil, particularly as recent discounts had diminished,” famous MK Surana, former chairman of Hindustan Petroleum.Also Read | Russia crude oil restrictions: EU imposes sanctions on Rosneft’s India refinery, lowers oil price cap – the way it may benefit IndiaThis improvement significantly benefits state-operated corporations like Indian Oil, HPCL and BPCL, which have minimal European exports while being important purchasers of Russian oil, in line with the ET report.“Most Russian purchases by Indian refiners are on a delivered basis so suppliers and traders will have to figure out the way to navigate through sanctions on vessels,” Surana was quoted as saying.