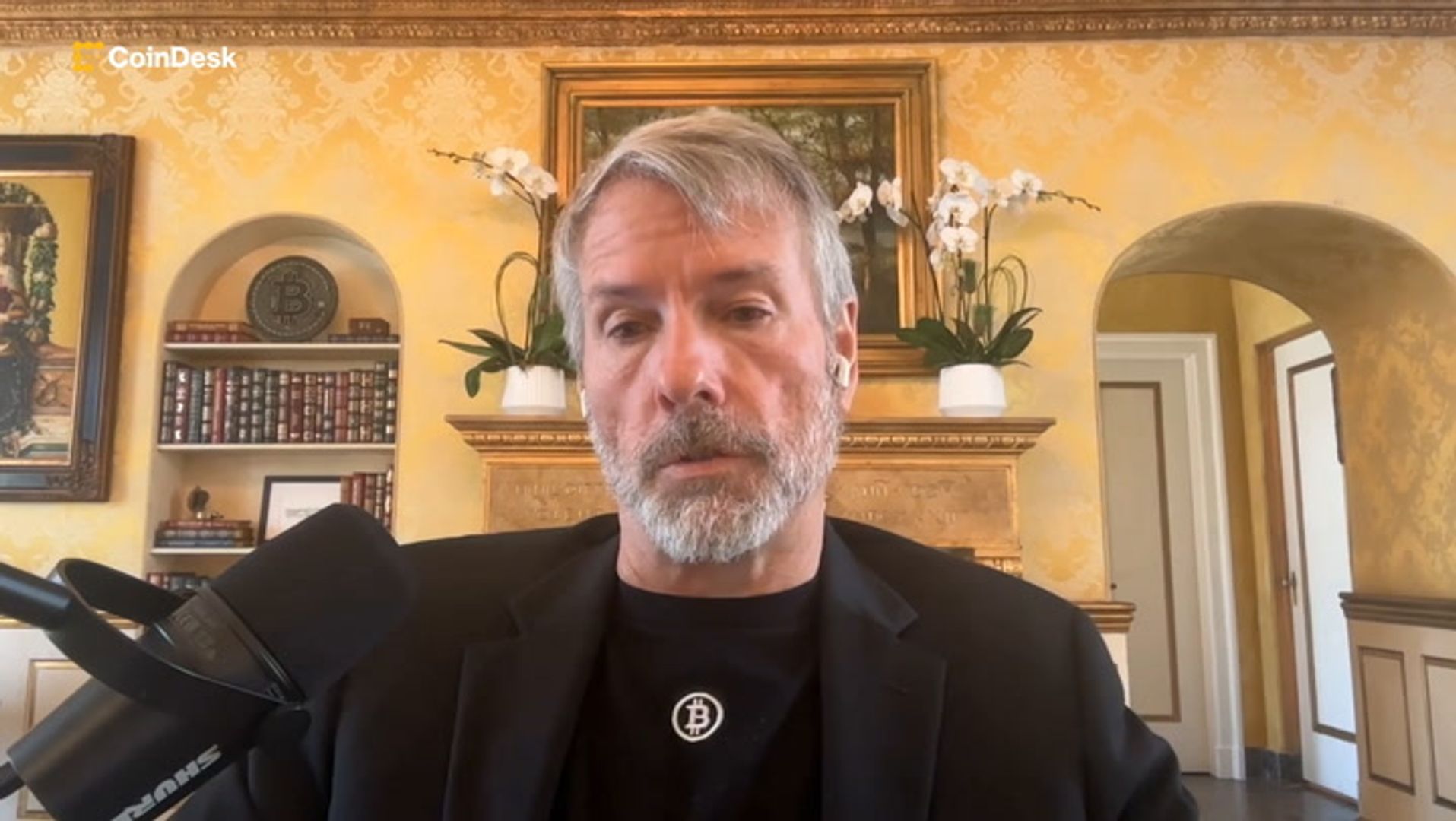

Now Reading: Michael Saylor Is Bringing Bitcoin-Backed Money-Market-Style Vehicle to Wall Street: NYDIG

-

01

Michael Saylor Is Bringing Bitcoin-Backed Money-Market-Style Vehicle to Wall Street: NYDIG

Michael Saylor Is Bringing Bitcoin-Backed Money-Market-Style Vehicle to Wall Street: NYDIG

Strategy (MSTR) is pulling off some type of monetary alchemy: utilizing bitcoin, traditionally a risky asset, to create one thing that appears rather a lot like stability.

That’s the agency’s $2 billion “Stretch” Preferred Stock (STRC) providing gives a variable 9% dividend and is designed to hold the share worth hovering close to $100.

The providing doesn’t give buyers direct bitcoin publicity, but it's backed by the asset in spirit and construction, in accordance to a current NYDIG report.

Strategy holds $71.7 billion in bitcoin and simply $11 billion in liabilities, giving it room to ship earnings even when crypto costs dip, the report notes.

Historically, bitcoin has returned at the least 3%–4% yearly over any five-year stretch, whereas common returns have been considerably increased.

Strategy is betting it may use this return profile to maintain excessive payouts with out touching its crypto stash, basically turning long-term bitcoin appreciation into month-to-month money move.

“STRC looks to us like a high-yield, bitcoin-backed, money-market-style vehicle, designed to trade near $100 par while offering a far higher yield than traditional short-term instruments, albeit with a different liquidity profile,” NYDIG wrote.

That premise has confirmed well-liked. Investor curiosity drove Strategy to quadruple the providing measurement from $500 million to $2 billion.

STRC might not simply be a yield car, however relatively bitcoin, reworked for conventional finance earnings buyers. A form of money-market fund, remixed with crypto beneath the hood.

Read extra: Michael Saylor Builds Out Own Yield Curve With Upsized Preferred Stock Sale