Now Reading: LINK Rebounds 4% as Chainlink Roll Outs Data Streams for U.S. Equities and ETFs

-

01

LINK Rebounds 4% as Chainlink Roll Outs Data Streams for U.S. Equities and ETFs

LINK Rebounds 4% as Chainlink Roll Outs Data Streams for U.S. Equities and ETFs

The value of LINK (LINK), native token of oracle supplier Chainlink, climbed 4% on Monday extending its rebound from late final week's crypto carnage.

The token hit $17 through the session, up almost 10% from the weekend lows, CoinDesk information exhibits.

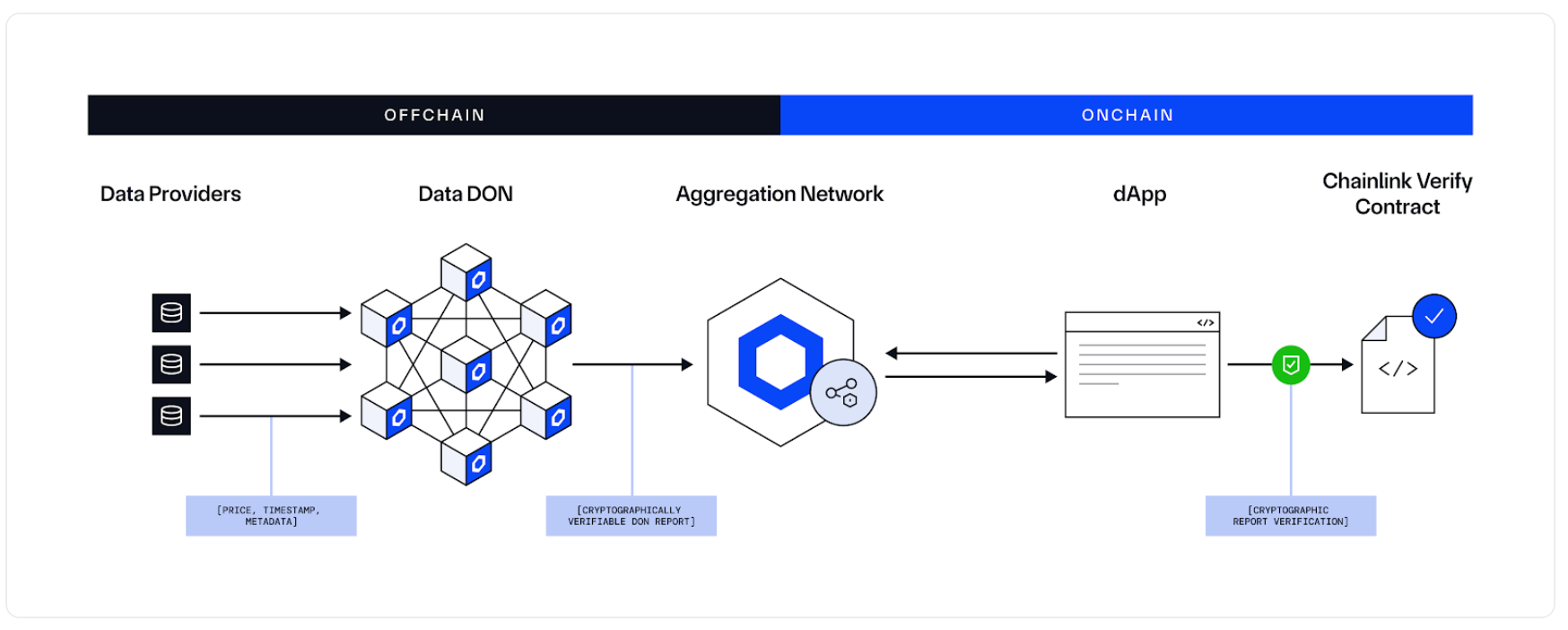

The transfer occurred as Chainlink rolled out market information feed for U.S. Equities and ETFs, aiming to attach conventional monetary instrument with on-chain capital markets. Chainlink Data Streams now present “real-time, high-throughput pricing” for property such as SPY, QQQ, NVDA, AAPL, MSFT, and different devices throughout 37 blockchain networks, in line with a weblog publish. The function allows use instances such as tokenized inventory buying and selling, perpetual futures and artificial ETFs on blockchain rails.

Solana-based DeFi protocol Kamino and decentraliized perpetuals buying and selling venue GMX have already began utilizing the service, in line with the publish.

“This is a significant leap forward for tokenized markets — closing a critical gap between traditional finance and blockchain infrastructure,” Johann Eid, Chief Business Officer at Chainlink Labs, mentioned within the publish.

Technical Analysis Shows Strong Momentum

LINK exhibited outstanding bullish efficiency all through the 24-hour buying and selling session, climbing from $16.16 to $16.87 and delivering a considerable 4.39% acquire, in line with CoinDesk Research's technical evaluation mannequin.

The persistent upward momentum, distinguished by progressively greater lows and constantly above-average quantity throughout rally phases, signifies sustained bullish market sentiment with robust potential for extra features focusing on the $17.00 psychological threshold, the mannequin mentioned.

Technical Indicators

- Normal help established at $16.11 representing the preliminary session low through the 24-hour interval.

- High-volume help confirmed at $16.29 through the midnight UTC surge with vital buying and selling exercise.

- Key resistance shaped at $16.87 with robust quantity affirmation and a number of check makes an attempt.

- Volume spike to 1,533,754 items through the 4 August 13:00 hour, almost triple the common quantity.

- Breakout sample confirmed from $16.65 to $16.83 establishing vital resistance turned help degree.

- Higher lows sample maintained all through the rally indicating sustained bullish momentum.

- Volume affirmation above 30,000 items throughout key rally phases supporting upward value motion.

Disclaimer: Parts of this text have been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk's full AI Policy.