Now Reading: GST cut on necessities: FMCG leaders hail ‘game-changing’ reform; prices may fall up to 10%

-

01

GST cut on necessities: FMCG leaders hail ‘game-changing’ reform; prices may fall up to 10%

GST cut on necessities: FMCG leaders hail ‘game-changing’ reform; prices may fall up to 10%

The GST Council’s resolution to slash tax charges on on a regular basis necessities and personal-use merchandise forward of the festive season is predicted to revive home consumption, elevate rural demand, and strengthen progress within the FMCG sector, business leaders mentioned on Thursday.According to information company PTI, FMCG firms plan to move on the advantages to shoppers both by rising grammage or chopping stock-keeping unit (SKU) prices, with analysts estimating worth drops of 8–10% relying on manufacturers, translating into 2–3% progress for the business.

Calling the transfer “game changing”, Marico MD & CEO Saugata Gupta mentioned, “By making essential consumer products more affordable, especially in the run-up to the festival season, these reforms will play a pivotal role in stimulating economic momentum and building long-term growth in the FMCG sector.”Dabur CEO Mohit Malhotra termed it a “timely and transformative move,” stressing that the cuts will make soaps, shampoos and toothpastes extra inexpensive, whereas driving demand in rural and semi-urban markets.Godrej Consumer Products CFO Aasif Malbari welcomed the choice, stating the corporate was dedicated to passing on advantages to shoppers. The All India Consumer Products Distributors’ Federation (AICPDF) mentioned the discount would enhance distributor and retailer liquidity by Rs 4,000–5,000 crore, whereas boosting rural consumption by an estimated 8–10% within the subsequent two quarters.

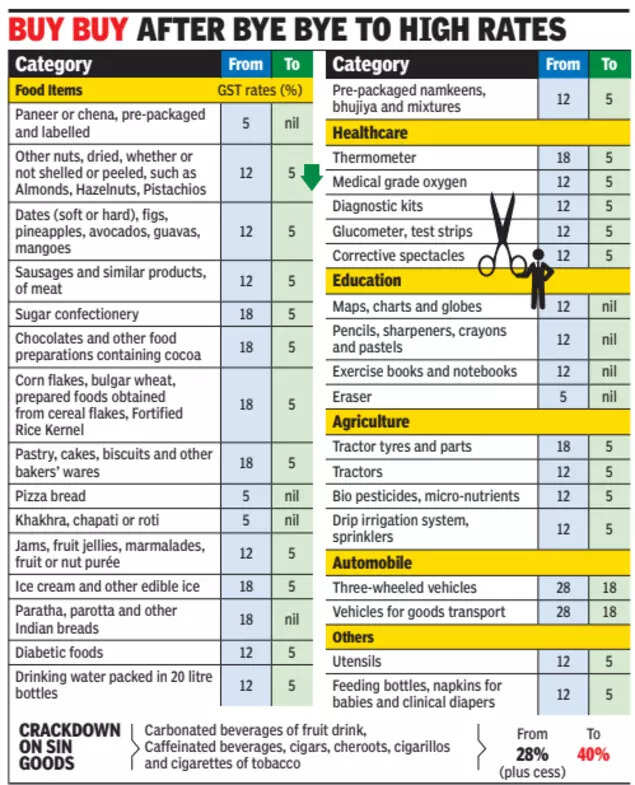

Shares of main FMCG corporations surged following the Council’s approval. Britannia, Dabur, HUL, Nestlé and Emami all logged sturdy positive factors on the BSE, whereas shopper durables and cement shares additionally rallied. The GST cuts cowl a variety of things, from hair oil, shampoo, toothpaste and cleaning soap to meals merchandise like butter, dry fruits, ice cream, biscuits and drinks, with charges slashed to 5% from 12% or 18%. Cement will now entice 18% GST as an alternative of 28%.As per PTI, Joy Personal Care Chairman Sunil Agarwal mentioned rural India, already driving FMCG progress for six quarters, will see additional demand power. Industry executives added that retailers are bracing for sturdy competition gross sales rebound as firms implement revised prices on current inventory.Grant Thornton Bharat’s Naveen Malpani famous that the cuts may lead to worth drops of 8–10% relying on provide chain efficiencies, additional stimulating consumption.Industry consultants consider the reforms will add 2–3 share factors to FMCG sector progress, which is at the moment increasing at 10–12% yearly, making the reform a “landmark step” forward of the festive season.