Now Reading: A Startup Is Looking to Pay 30% Yield by Tokenizing AI Infrastructure

-

01

A Startup Is Looking to Pay 30% Yield by Tokenizing AI Infrastructure

A Startup Is Looking to Pay 30% Yield by Tokenizing AI Infrastructure

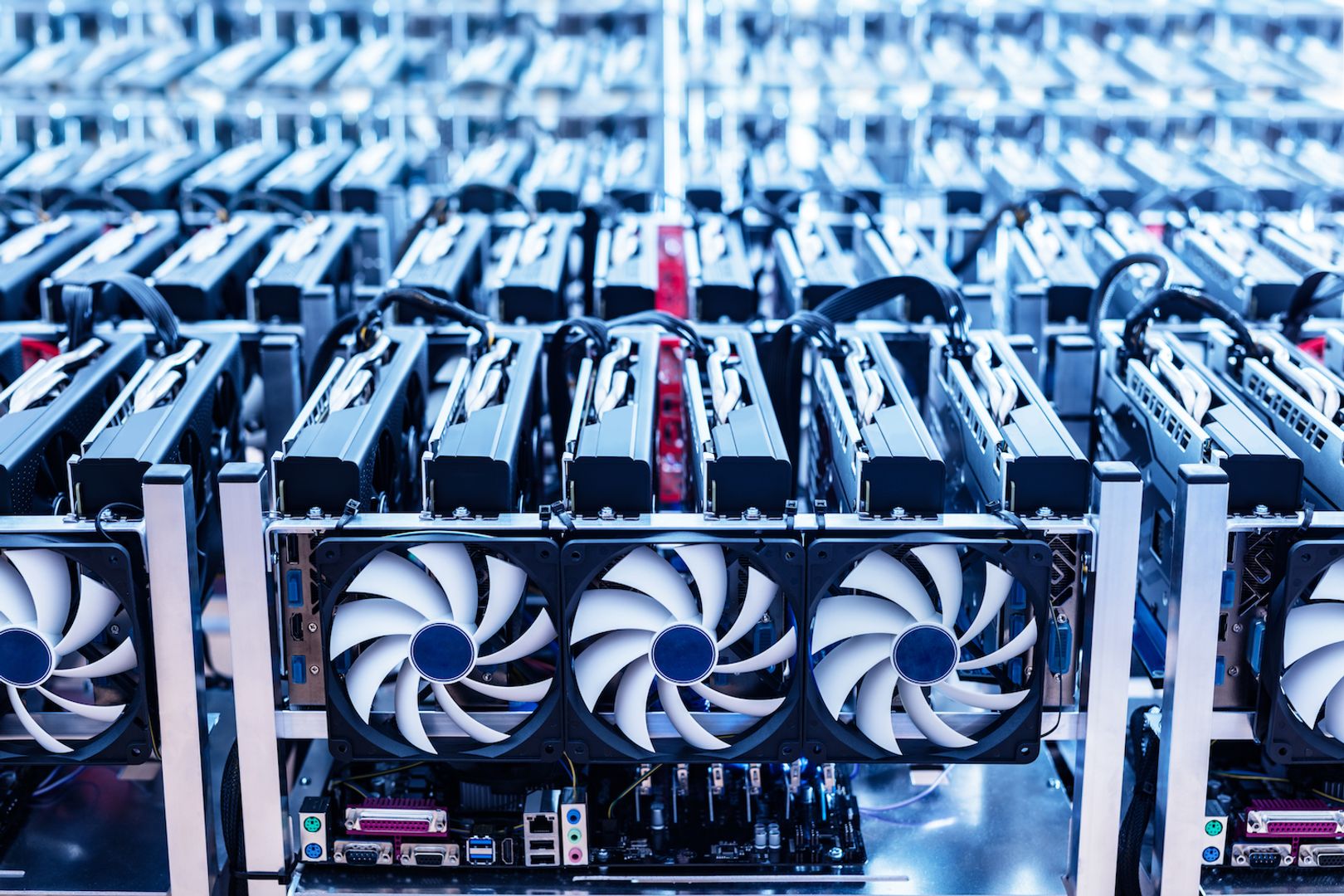

Compute Labs, a startup that turns the industrial-grade GPUs that energy AI information centres into fractionalized yield-bearing tokens, and enterprise AI cloud agency NexGen Cloud, have joined forces to start distributing possession of a $1 million “public vault,” the businesses stated on Wednesday.

The energy and profitability of AI infrastructure are largely centralized and customarily confined to hyperscalers like AWS or giant venture-backed corporations. However, Compute Labs is trying to convey its token holders direct entry to the incomes potential of enterprise {hardware} similar to NVIDIA H200 GPUs, which might retail at round $30,000 for a single unit.

“For investors, this pilot [project] represents the first-ever opportunity to earn stablecoin yield directly from live AI compute without having to manage the hardware or rely on overvalued public equities,” Compute Labs stated in a press launch.

Europe’s NexGen, which supplies its prospects entry to AI computing energy and had raised $45 million in April, will deal with the preliminary financing by means of its funding arm InfraHub Compute.

How it really works

The funds raised can be used by InfraHub to purchase GPUs, which can then be fractionalised for buyers and prospects, in accordance to the press launch.

The first “vault” has already raised $1 million from buyers. The preliminary vault may have top-of-the-range NVIDIA GPUs, that are at the moment used for “AI training and inference,” the agency stated. The corporations are projecting to have a yield, in USDC, that may go over 30% per yr based mostly on energetic enterprise GPU rental agreements.

Nikolay Filichkin, chief enterprise officer at Compute Labs, talks to the kind of information middle operators who might need extra ground house and are wanting to add additional capability; the information middle equal of “mom and pop shops,” he stated in an interview with CoinDesk.

“When the data center is using the GPU owned by an investor, Compute Labs manages that through its protocol and balance sheet, and leases the GPUs to the data center,” Filichkin stated in an interview. “The net revenue, minus things like hosting and energy costs, goes back to the investor who owns a slice of the GPU processing power.”

The corporations tokenize and fractionalize these GPUs inside the vaults, which may then be provided to particular person buyers in increments of some hundred {dollars}. NFTs are additionally used to distinguish between various forms of tokenized GPU {hardware} investments.

Compute Labs is backed by Protocol Labs, OKX Ventures, CMS Holdings and Amber Group, amongst others. The agency operates with a flat 10% price construction throughout tokenization, asset administration and efficiency yield.

“This mannequin assigns concrete, tradable worth to every GPU cycle, rationalizing the AI market by eradicating the hypothesis of buyers, and immediately linking provide, demand, and worth,” stated Youlian Tzanev, co-founder and chief technique officer at NexGen Cloud.