Now Reading: Bitcoin Demand Outstrips Supply Ahead of August Lull: Crypto Daybook Americas

-

01

Bitcoin Demand Outstrips Supply Ahead of August Lull: Crypto Daybook Americas

Bitcoin Demand Outstrips Supply Ahead of August Lull: Crypto Daybook Americas

By James Van Straten (All occasions ET except indicated in any other case)

Bitcoin (BTC) has dropped 3% prior to now 24 hours and is at present some 7% under its June 14 all-time excessive.

This raises the query of how a lot additional it’d drop. In the context of a seamless bull market, double-digit corrections should not uncommon, with the most important drawdown reaching 30% since this cycle started in January 2023.

One technical issue to regulate is the CME Bitcoin Futures hole between $114,355 and $115,670. These gaps sometimes happen when value motion occurs exterior of the CME's buying and selling hours, usually over weekends, and so they usually get stuffed later as the worth revisits these ranges.

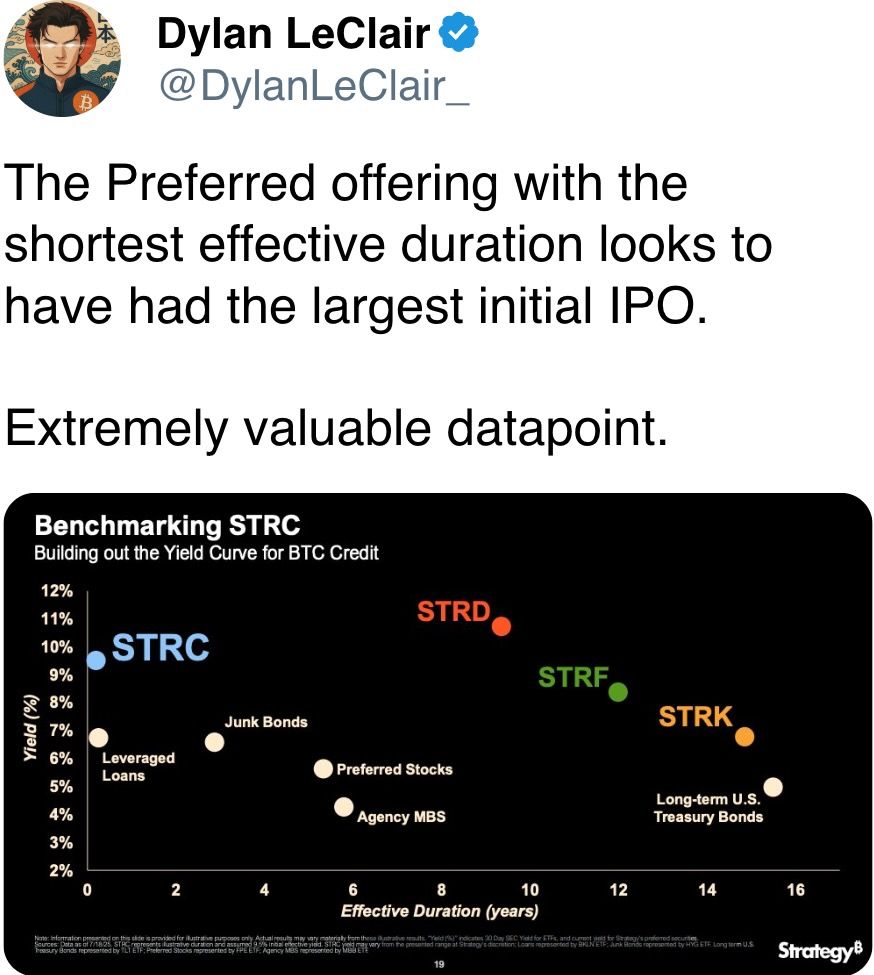

In different information, Strategy (MSTR) reportedly quadrupled the dimensions of its Stretch (STRC) perpetual most well-liked inventory sale. Analyst Brian Brookshire notes the providing consists of 28 million STRC shares. At $90 a pop, that totals over $2.5 billion and potential demand for some 21,500 BTC given a value of $115,000.

Meantime, demand already appears to be outstripping provide, in response to on-chain information from Glassnode. Since early this month, greater than 210,000 BTC has been bought by long-term holders (those that've owned their BTC for longer than 155 days) and about 250,000 BTC purchased by short-term holders, the information reveals.

With the month-end only a week away, bitcoin is about 8% increased than in the beginning. That's in step with its historic pattern. On common, the most important cryptocurrency has returned about 7% in July since 2013.

Ether (ETH), for its half, has surged over 46% and is at present buying and selling close to $3,725. This is the third time it's topped 40% since November. Interestingly, in all the opposite months, it fell.

August is often quieter, which regularly ends in decrease market liquidity. Stay alert!

What to Watch

- Crypto

- July 28: Starknet (STRK), an Ethereum layer-2 validity rollup (zk-rollup), launches v0.14.0 on mainnet.

- July 31, 12 p.m.: A reside webinar that includes Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo discussing bitcoin’s potential as the following international reserve foreign money amid de-dollarization tendencies. Registration hyperlink.

- Aug. 1: The Helium Network (HNT), now operating on Solana, undergoes its halving occasion, chopping annual new token issuance to 7.5 million HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes impact, introducing a licensing regime to manage stablecoin actions within the metropolis.

- Aug. 15: Record date for the subsequent FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution necessities.

- Macro

- July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured sturdy items orders information.

- Durable Goods Orders MoM Est. -10.8% vs. Prev. 16.4%

- Durable Goods Orders Ex Defense MoM Prev. 15.5%

- Durable Goods Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.5%

- July 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases June unemployment charge information.

- Aug. 1, 12:01 a.m.: New U.S. tariffs take impact on imports from buying and selling companions that failed to succeed in agreements by the July 9 deadline. These elevated duties might vary from 10% to as excessive as 70%, impacting a variety of items.

- July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured sturdy items orders information.

- Earnings (Estimates based mostly on FactSet information)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck Group (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting on a proposal to promote its treasury of round 16 million GHST for round 3.2 million USDC to VC agency Rongming Investment , dissolve the DAO and distribute funds to energetic members. The VC agency goals to scale Aavegotchi globally whereas Pixelcraft retains IP possession. Voting ends July 25.

- Lido DAO is voting on a new system that lets validator exits be triggered robotically via the execution layer, not simply by node operators. It consists of instruments for various authorization pathways, emergency controls, and constructed‑in limits to stop misuse. The replace is predicted to make staking extra decentralized, safer and extra responsive. Voting ends July 28.

- GnosisDAO is voting on a proposal to present $30 million a 12 months, paid quarterly, to Gnosis Ltd., now a non-profit, to maintain its 150‑individual staff constructing vital Gnosis Chain infrastructure, merchandise (like Gnosis Pay and Circles), enterprise growth and operations. Voting ends July 28.

- Aavegotchi DAO is voting on funding three new options for the official decentralized software: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- NEAR Protocol is voting on probably lowering NEAR’s inflation from 5% to 2.5%. Two-thirds of validators should approval the proposal for it to move, and in that case it might be carried out by late Q3. Voting ends Aug. 1.

- July 25: MEXC, Ethena and TON to host an X Spaces session on “Stablecoin for You & Me.”

- July 29, 10 a.m.: Ether.fi to host a bi-quarterly analyst name.

- Unlocks

- July 28: Jupiter (JUP) to unlock 1.78% of its circulating provide price $28.77 million.

- July 31: Optimism (OP) to unlock 1.79% of its circulating provide price $22.08 million.

- Aug. 1: Sui (SUI) to unlock 1.27% of its circulating provide price $162.78 million.

- Aug. 2: Ethena (ENA) to unlock 0.64% of its circulating provide price $22.29 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating provide price $13.38 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating provide price $53.27 million.

- Token Launches

- July 25: 5ireChain (5IRE), Aperture Finance (APTR), Ertha (ERTHA), Gummy (GUMMY), Pip (PIP), and Teleport System Token (TST) to be delisted from Bybit.

Conferences

The CoinDesk Policy & Regulation convention (previously often called State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that enables basic counsels, compliance officers and regulatory executives to fulfill with public officers accountable for crypto laws and regulatory oversight. Space is proscribed. Use code CDB10 for 10% off your registration via Aug. 31.

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

- WWE legend Hulk Hogan died Thursday following a cardiac arrest, triggering a wave of tribute posts for the wrestler and a near-instant surge of branded memecoins on Ethereum and Solana.

- The newly launched Wrapped ETH token “Hulkamania (HULK)” pumped over 122,000% inside hours of deployment, peaking at $0.001335 and briefly hitting a seven-figure market cap, in response to DEXTools.

- On Solana, a memecoin named HULKAMANIA (HULK) — launched in June 2024 — surged over 2,000% in 24 hours, buying and selling close to $0.0006146 with a revived market cap of $500,000.

- Despite the rally, the Solana-based HULK remains to be far under its $18.8 million all-time excessive from final 12 months, which adopted a now-deleted promotional tweet from Hogan’s official X account.

- Hogan, on the time, claimed the publish wasn’t made by him.

- None of the present HULK tokens are formally affiliated with Hogan’s property or model and a number of copycat variations have already vanished from the DEX panorama, suggesting they’re possible rug pulls and honeypots.

- Hogan joins a rising record of celebrities whose posthumous memecoins see speedy speculative inflows, usually fueled by nostalgia, shock and social media virality earlier than liquidity drains as quick because it arrives.

- It's price remembering that tribute memecoins supply no legitimacy, no roadmap and no protections regardless of usually being the fastest-moving tokens on DEX platforms throughout news-driven spikes.

Derivatives Positioning

- Open curiosity (OI) for bitcoin throughout prime derivatives venues stays in any respect time highs.

- According to Velo, OI at present sits at $34.1 billion. Binance nonetheless leads with $14.2 billion open curiosity adopted by Bybit at $9.5 billion.

- Three-month annualized foundation for BTC is at 6.3%, dropping off from 9% earlier within the week.

- In phrases of perpetual volumes, ETH volumes at present exceed BTC volumes at 140.6 billion versus 121.4 billion respectively, as per Coinglass.

- Bitcoin put-call quantity at present stands at 44,600 contracts, with calls accounting for 52% of the overall, in response to Velo. Options OI for bitcoin is slightly below all time highs at $83.5 billion, in response to Coinglass.

- Ether, alternatively, at present has 196,400 put-call contract quantity with 54% being calls. Open curiosity is at present at $9.6 billion, under the March 2024 all-time excessive of $14.8 billion.

- Funding charge APRs for BTC are muted throughout most venues besides Hyperliquid, the place the speed at present is at 90% annualized funding. This is nicely above altcoins resembling SOL and HYPE, which at present present an annualized funding of 10% and 32%, respectively, as per Coinglass.

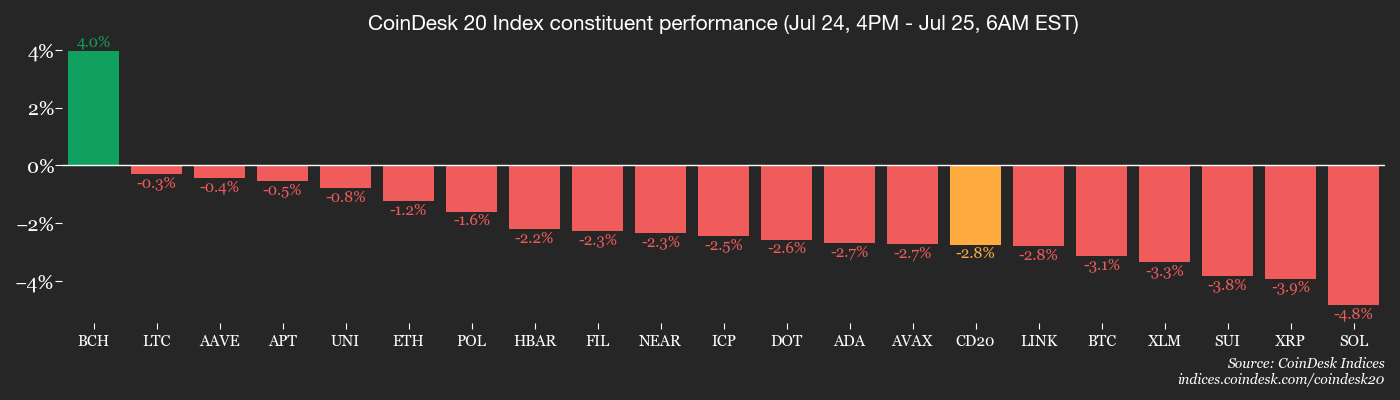

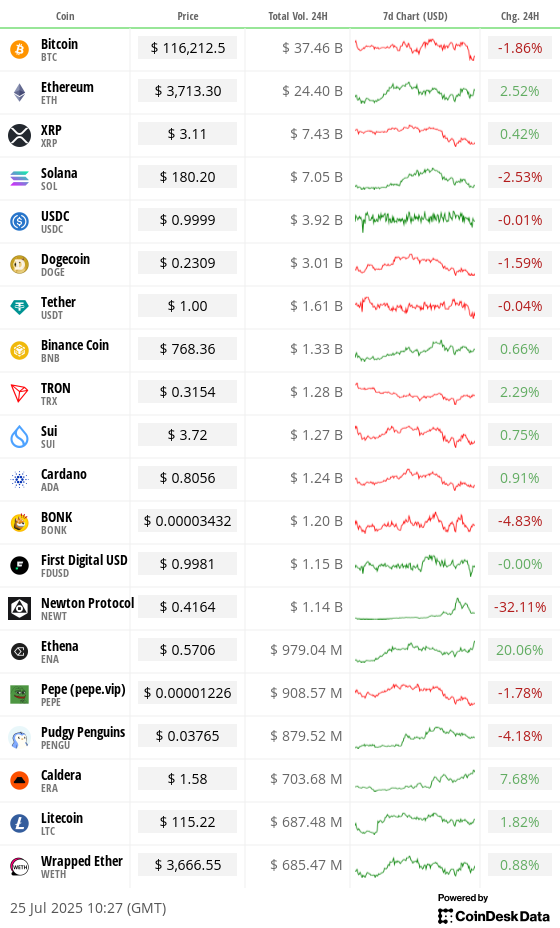

Market Movements

- BTC is down 2.39% from 4 p.m. ET Thursday at $115,912.54 (24hrs: -1.99%)

- ETH is down 0.41% at $3,721.30 (24hrs: +2.54%)

- CoinDesk 20 is down 1.94% at 3,940.10 (24hrs: +0.64%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.96%

- BTC funding charge is at 0.0367% (40.1865% annualized) on KuCoin

- DXY is up 0.32% at 97.68

- Gold futures are down 0.72% at $3,349.30

- Silver futures are down 0.34% at $39.09

- Nikkei 225 closed down 0.88% at 41,456.23

- Hang Seng closed down 1.09% at 25,388.35

- FTSE is down 0.29% at 9,112.22

- Euro Stoxx 50 is down 0.15% at 5,347.34

- DJIA closed on Thursday down 0.70% at 44,693.91

- S&P 500 closed unchanged at 6,363.35

- Nasdaq Composite closed up 0.18% at 21,057.96

- S&P/TSX Composite closed down 0.16% at 27,372.26

- S&P 40 Latin America closed down 0.44% at 2,627.58

- U.S. 10-Year Treasury charge is up 1.2 bps at 4.42%

- E-mini S&P 500 futures are unchanged at 6,407.00

- E-mini Nasdaq-100 futures are unchanged at 23,374.00

- E-mini Dow Jones Industrial Average Index are up 0.13% at 44,956.00

Bitcoin Stats

- BTC Dominance: 61.46% (-0.58%)

- Ether-bitcoin ratio: 0.03184 (1.65%)

- Hashrate (seven-day transferring common): 914 EH/s

- Hashprice (spot): $59.04

- Total charges: 9.82 BTC / $1,166,840

- CME Futures Open Interest: 147,320 BTC

- BTC priced in gold: 34.4 oz.

- BTC vs gold market cap: 9.66%

Technical Analysis

- Ethena's ENA has been one of the strongest performers available in the market, following the announcement of StablecoinX, a SPAC that has raised $360 million to amass ENA as treasury holdings.

- On the day by day timeframe, ENA has damaged its downtrend and retested the earlier resistance at $0.45.

- This bullish narrative is additional supported by the confluence of reclaiming Monday’s low and the 50-day exponential transferring common on the weekly chart.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $414.92 (+0.55%), -2.44% at $404.79 in pre-market

- Coinbase Global (COIN): closed at $396.7 (-0.28%), -1.75% at $389.74

- Circle (CRCL): closed at $193.08 (-4.61%), -0.64% at $191.84

- Galaxy Digital (GLXY): closed at $31.89 (+2.77%), -4.2% at $30.55

- MARA Holdings (MARA): closed at $17.26 (-1.76%), -2.95% at $16.75

- Riot Platforms (RIOT): closed at $14.69 (+2.44%), -2.59% at $14.31

- Core Scientific (CORZ): closed at $13.69 (+1.48%), unchanged in pre-market

- CleanSpark (CLSK): closed at $12.34 (-0.88%), -2.35% at $12.05

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.11 (-0.84%)

- Semler Scientific (SMLR): closed at $38.89 (-1.09%), -3.57% at $37.5

- Exodus Movement (EXOD): closed at $33.61 (-1.75%), +3.01% at $34.62

- SharpLink Gaming (SBET): closed at $23.32 (-9.65%), +2.44% at $23.89

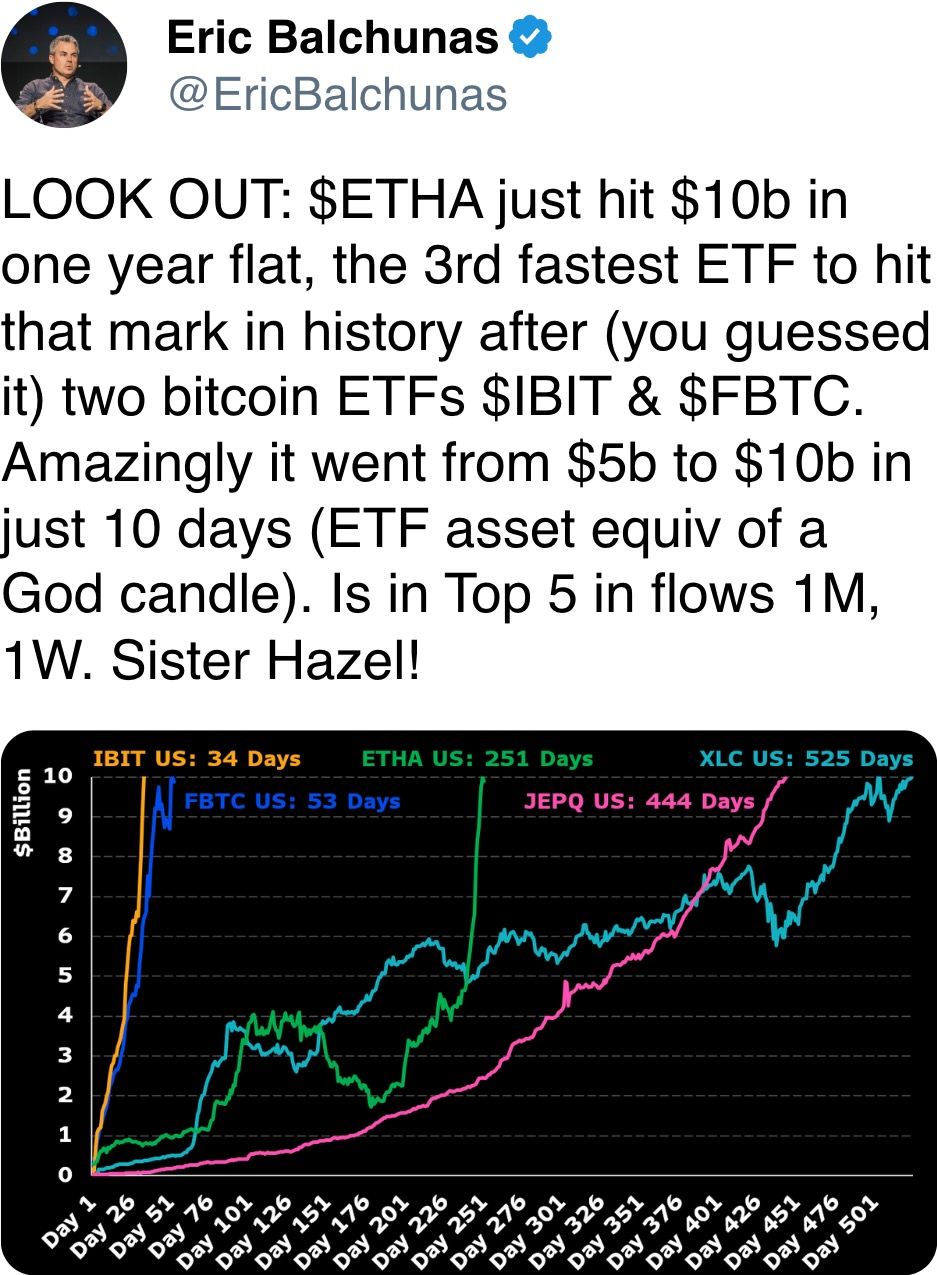

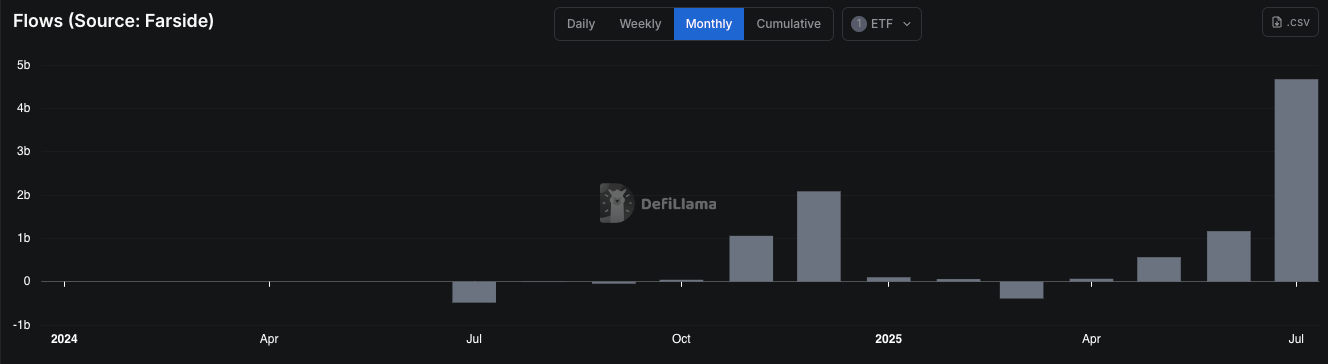

ETF Flows

Spot BTC ETFs

- Daily internet flows: $226.7 million

- Cumulative internet flows: $54.67 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily internet flows: $231.2 million

- Cumulative internet flows: $8.9 billion

- Total ETH holdings ~5.34 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Spot ether ETFs within the U.S. have recorded $4.67 billion in internet inflows in July alone, surpassing the overall cumulative internet inflows of $4.23 billion gathered from inception via June.

While You Were Sleeping

- Trump’s Tariffs Are Being Picked Up by Corporate America (The Wall Street Journal): American firms are largely delaying value hikes and absorbing tariff prices for now as international sellers supply restricted reduction and President Trump’s commerce offers add uncertainty over who finally pays.

- Iran Starts New Talks Today Over Its Nuclear Program. Here’s What to Know. (The New York Times): European officers resumed talks with Iran in Istanbul, warning they’ll restore suspended U.N. sanctions by the tip of subsequent month if Tehran doesn’t reengage with the U.S. and curb uranium enrichment.

- Bitcoin to Hit $135K by Year-End in Base-Case Forecast, $199K in Bullish Scenario: Citi (CoinDesk): In the financial institution's most bearish setup, the forecast drops to $64,000.

- Companies Load Up on Niche Crypto Tokens to Boost Share Prices (Financial Times): Some public firms are turning to altcoin treasuries to distinguish and enhance valuation. Analysts say this speculative pattern gives no long-term answer for corporations already dealing with monetary misery.

- Volmex's Bitcoin and Ether Volatility Futures Top $10M Volume Since Debut as Traders Look Beyond Price (CoinDesk): Traders are utilizing these not too long ago launched merchandise on the decentralized platform to precise views on market turbulence with out taking a directional stance on BTC/ETH costs or managing complicated choice methods.

- Digital Assets Firm OSL Raises $300 Million to Expand Crypto Business Worldwide (Bloomberg): As Hong Kong awaits its stablecoin legislation taking impact Aug. 1, the CFO of one of its earliest licensed exchanges says the brand new funding will assist a broader push into abroad digital asset markets.

In the Ether