Now Reading: Bitcoin Slips Below $104K, Cryptos Slide as U.S.-China Tariff Tensions Flare Up

-

01

Bitcoin Slips Below $104K, Cryptos Slide as U.S.-China Tariff Tensions Flare Up

Bitcoin Slips Below $104K, Cryptos Slide as U.S.-China Tariff Tensions Flare Up

Markets went crimson on Friday on renewed tariff-related apprehensions.

Bitcoin

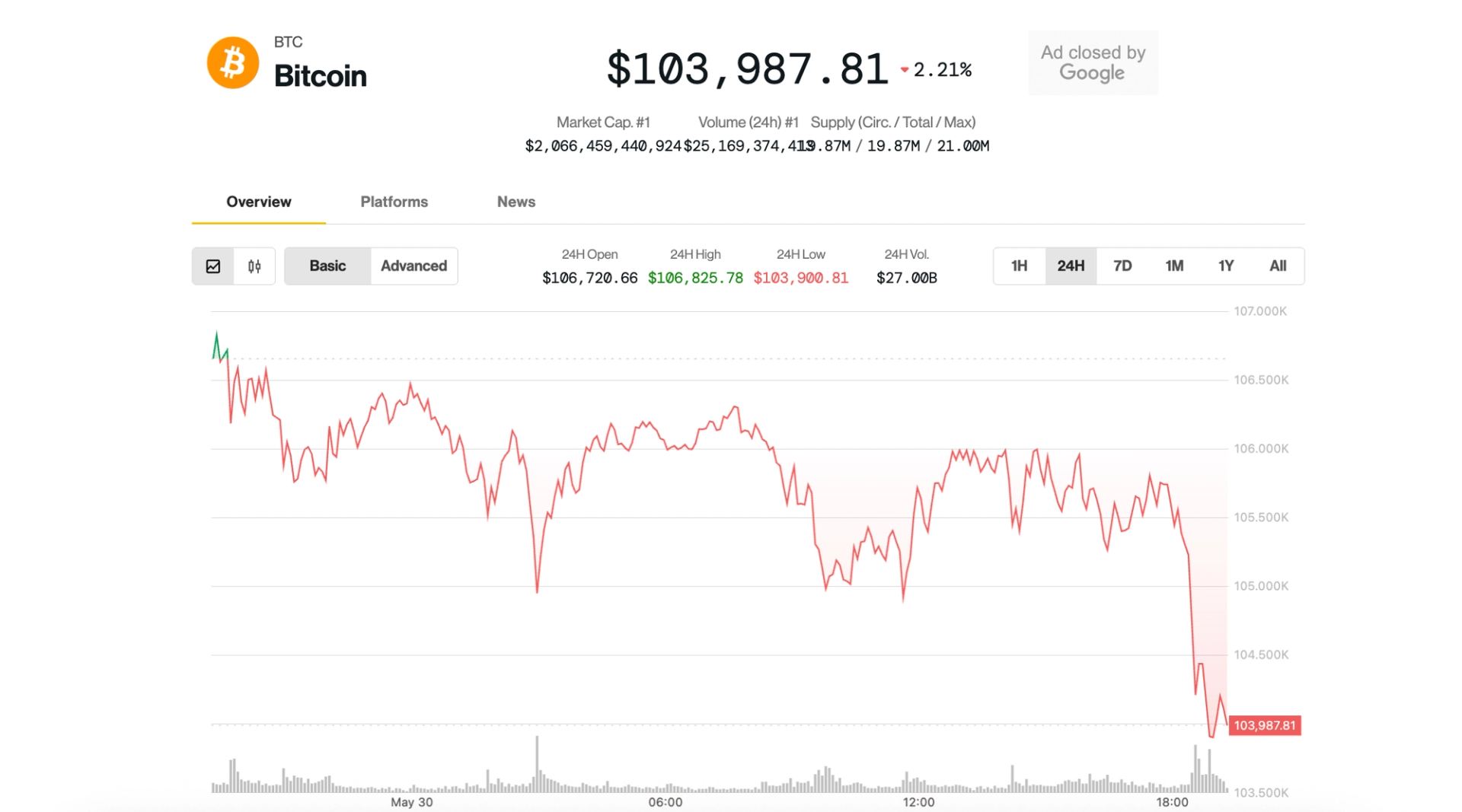

is down 2.1% within the final 24 hours, buying and selling simply above $104,000 after briefly hitting a session low of $103,900. The CoinDesk 20 — an index of the highest 20 cryptocurrencies by market capitalization, apart from stablecoins, memecoins and alternate cash — slumped even additional, by 4.2%.

Smart contract platforms have been significantly affected, with solana

, sui and avalanche shedding 6.3%, 7.8% and seven.3% respectively.

Crypto shares additionally took a success, particularly bitcoin mining agency Bitdeer (BTDR), down 8.3% on the day after a run-up that noticed the inventory rise 132% from April 16 to May 21. Strategy (MSTR) slid 2.7%, and Coinbase (COIN) 1.3%.

The bleeding wasn’t contained to crypto. The S&P 500 and Nasdaq are down 1% and 1.5% respectively, whereas gold misplaced 0.7%.

U.S.-China tariff conflict: Round 2?

Behind the value motion was the flare-up of U.S. commerce tensions as soon as once more after an settlement was struck earlier this month. The issues got here after President Donald Trump accused China in a submit on Truth Social of “violating” the tariff truce between the nations.

Meanwhile, Treasury Secretary Scott Bessent stated in a Fox News interview that talks had “stalled” with the Chinese representatives.

China, in response, urged the U.S. to “immediately correct its erroneous actions, cease discriminatory restrictions,” BBC reported.

The cool-off between U.S. and China helped threat property rally in May, offering a tailwind for BTC to clinch a brand new report excessive. The re-escalation now threatens to unwind a few of these good points.

Read extra: Bitcoin Whales Seem to Be Calling a Top as BTC Price Consolidates