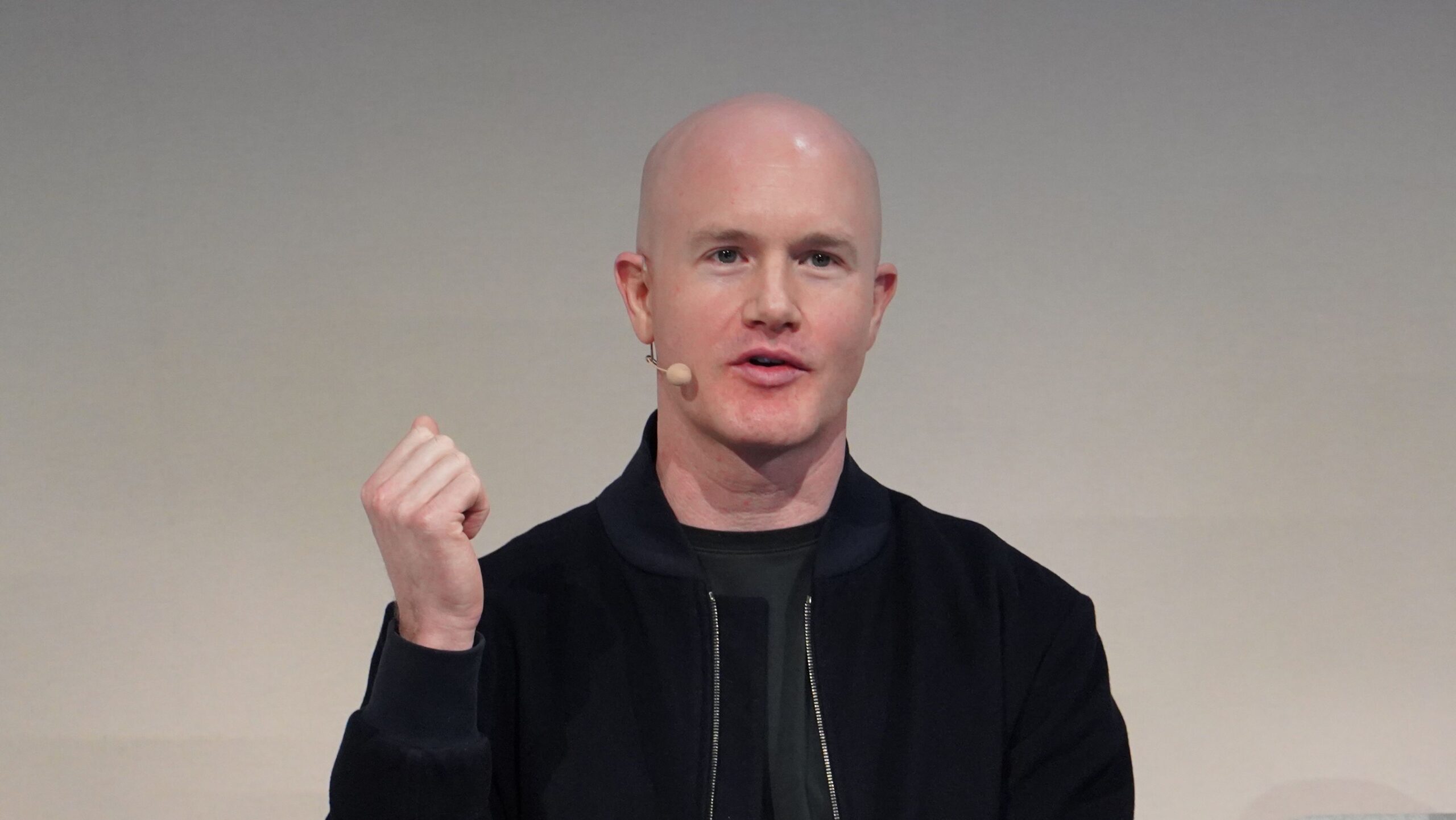

Now Reading: Coinbase Stock Soars Highest Since 2021 Nasdaq Debut

-

01

Coinbase Stock Soars Highest Since 2021 Nasdaq Debut

Coinbase Stock Soars Highest Since 2021 Nasdaq Debut

Shares of crypto change Coinbase (COIN) climbed to their highest degree since its April 2021 Nasdaq debut on Thursday, bringing the inventory almost full circle after plunging greater than 90% through the depths of 2022’s crypto winter.

COIN hit $382 Thursday earlier than paring among the good points and closed greater by 5.5%. The inventory’s greater than doubled since plunging alongside April’s tariff-induced market panic.

Coinbase’s 2021 itemizing marked a watershed second for the digital asset business, but additionally signaled a peak in crypto. The inventory rose as excessive as $382 earlier than sliding over 90% amid the extended 2022 bear market.

Now, traders are more and more positioning Coinbase as a long-term winner within the subsequent part of crypto progress, outlined by rising stablecoin adoption, institutional participation and rising U.S. regulatory readability.

The firm not too long ago launched Coinbase Payments, a brand new service geared toward increasing the change’s footprint in international commerce. Built on Coinbase’s Ethereum layer-2 community, Base, the platform permits retailers to simply accept 24/7 USDC stablecoin funds without having blockchain experience. It already integrates with platforms like Shopify, the corporate mentioned.

Coinbase additionally advantages from the rapidly-growing stablecoin sector, having a revenue-sharing settlement with Circle (CRCL), issuer of the USDC stablecoin, giving it a lower of the yield generated by reserve belongings.

The broader backdrop is supportive as nicely. The S&P500 and Nasdaq fairness indexes notch file highs, and crypto-related companies corresponding to Robinhood (HOOD) has additionally loved renewed investor curiosity.

Some analysts count on additional upside.

Benchmark raised its value goal to $421 on COIN, saying the corporate is nicely positioned to capitalize on potential U.S. laws, together with payments to control stablecoins and digital asset market construction.

Meanwhile, Bernstein set a extra bold $510 goal, calling Coinbase crypto’s rising “universal bank,” bridging retail customers, institutional traders and on-chain infrastructure at international scale.

Read extra: Coinbase Is the Most Misunderstood Business in Crypto, Says Analyst With Highest Wall Street Price Target