Now Reading: Crypto Daybook Americas: All Eyes on Jobs, Fed as Bitcoin Prepares for Breakout Rally

-

01

Crypto Daybook Americas: All Eyes on Jobs, Fed as Bitcoin Prepares for Breakout Rally

Crypto Daybook Americas: All Eyes on Jobs, Fed as Bitcoin Prepares for Breakout Rally

By Francisco Rodrigues (All instances ET until indicated in any other case)

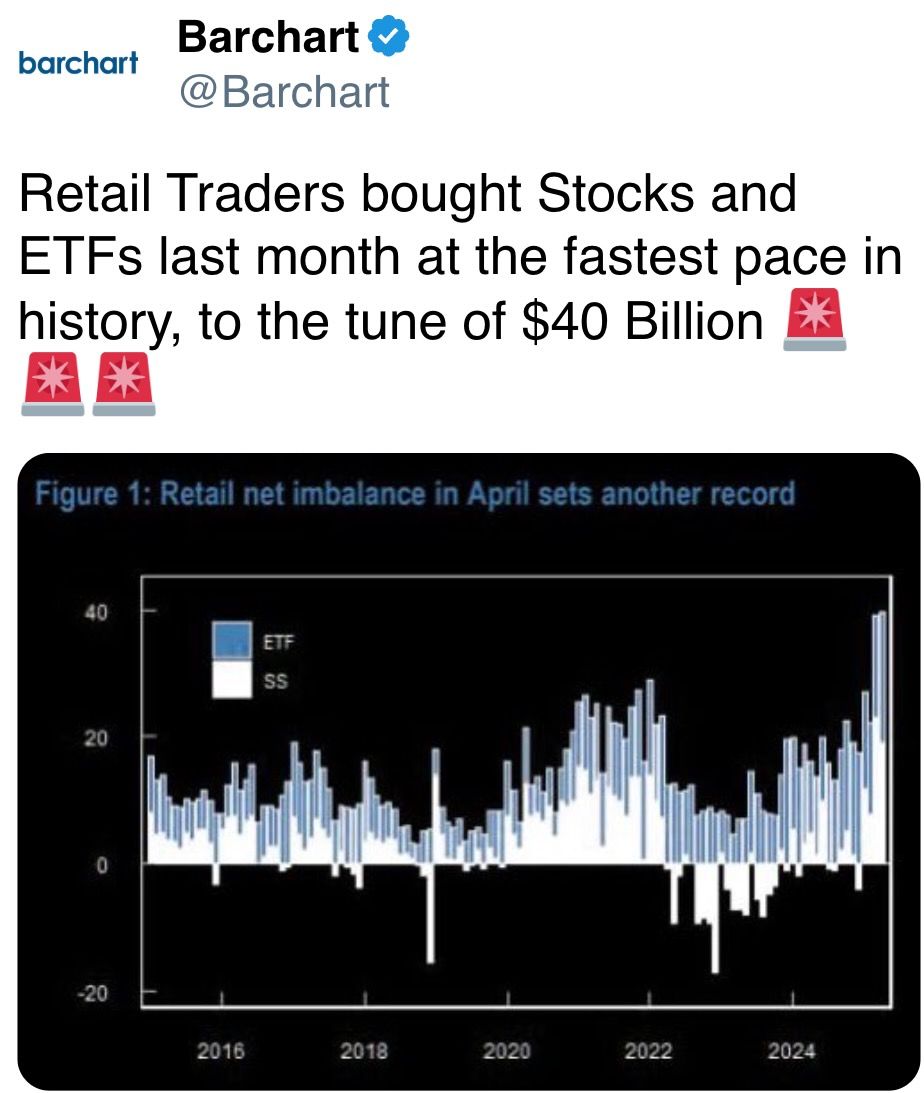

Markets appear bullish forward of the roles report due later Friday, with bitcoin (BTC) rising towards $97,000 after shares rose for an eighth straight day on Thursday. That gave the S&P 500 its longest rally since August as traders grew extra assured that commerce tensions between Washington and Beijing are cooling.

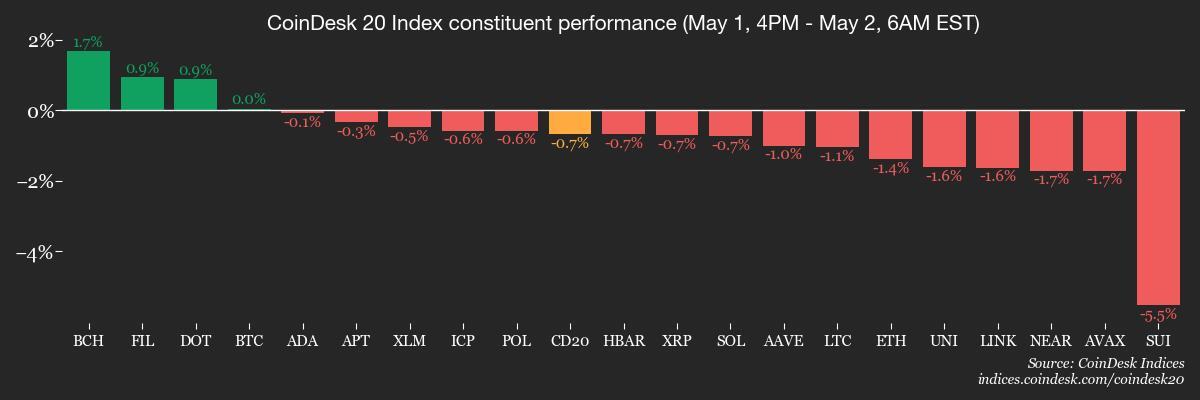

Still, the CoinDesk 20 (CD20) index is little modified over the past 24 hours with the drop in first-quarter GDP pointing to financial pressure from the commerce warfare. While merchants at the moment are betting the Federal Reserve may minimize interest-rates 4 instances this 12 months — yet one more than they'd priced in earlier than the reciprocal tariffs have been introduced — private consumption expenditures (PCE), the Fed's most popular measure of inflation got here in above forecasts, which limits the central financial institution's room for easing, mentioned James Butterfill, the pinnacle of analysis at CoinShares.

Today's payrolls knowledge stays a “critical piece of the puzzle,” he mentioned.

“When the Fed eventually decides to cut rates, it is likely to do so in a knee-jerk and forceful manner — reacting to a significant deterioration in economic conditions rather than being proactive. Such a dramatic policy shift could act as a catalyst for a significant breakout rally in bitcoin, as investors seek alternative stores of value amid aggressive monetary easing,” Butterfill mentioned.

That coverage shift may align with bitcoin’s historic efficiency. Since 2013, the cryptocurrency has seen a mean achieve of seven.52% in May, in response to CoinGlass knowledge. And it's not alone: ether (ETH), which has been considerably underperforming BTC, has posted a mean achieve of 27.3% in May since 2016, the best-performing month for the Ethereum blockchain's token.

“Investor confidence is gradually returning to crypto markets following a volatile start to the year, with April seeing a rebound across majors as tariff-driven macro fears eased,” mentioned Vijay Chetty, CEO of Eclipse. Growing regulatory readability is an “underappreciated catalyst that will set the stage for broader institutional use cases,” Chetty added. Stay alert!

What to Watch

- Crypto:

- May 5, 3 a.m.: IOTA’s Rebased community improve begins. Rebased strikes IOTA to a brand new community, boosting capability to as many as 50,000 transactions per second, providing staking rewards of 10%-15% a 12 months and including assist for MoveVM sensible contracts.

- May 5, 11 a.m.: The Crescendo community improve goes stay on the Kaspa (KAS) mainnet. This improve boosts the community’s efficiency by growing the block manufacturing charge to 10 blocks per second from 1 block per second.

- May 6: Casper Network (CSPR) launches its 2.0 mainnet improve, introducing quicker transactions, enhanced sensible contracts, and improved staking options to spice up enterprise adoption.

- May 7, 6:05 a.m.: The Pectra onerous fork community improve will get activated on the Ethereum (ETH) mainnet at epoch 364032. Pectra combines two main parts: the Prague execution layer onerous fork and the Electra consensus layer improve.

- Macro

- May 2, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April employment knowledge.

- Nonfarm Payrolls Est. 130K vs. Prev. 228K

- Unemployment Rate Est. 4.2% vs. Prev. 4.2%

- May 2, 9 a.m.: S&P Global releases Brazil April buying managers’ index (PMI) knowledge.

- Manufacturing PMI Prev. 51.8

- May 2, 11 a.m.: S&P Global releases Mexico April buying managers’ index (PMI) knowledge.

- Manufacturing PMI Prev. 46.5

- May 5, 9:45 a.m.: S&P Global releases (Final) U.S. April buying managers’ index (PMI) knowledge.

- Composite PMI Est. 51.2 vs. Prev. 53.5

- Services PMI Est. 51.4 vs. Prev. 54.4

- May 5, 10:00 a.m.: Institute for Supply Management (ISM) releases U.S. April financial exercise knowledge.

- Services PMI Est. 50.6 vs. Prev. 50.8

- May 2, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April employment knowledge.

- Earnings (Estimates based mostly on FactSet knowledge)

Token Events

- Governance votes & calls

- Compound DAO is voting on shifting 35,200 COMP (~$1.5 m) right into a multisig protected to check promoting coated calls on COMP for USDC, lend that USDC in Compound for further yield, then use the returns to purchase again COMP and repeat—concentrating on roughly 15 % annual achieve. Voting ends May 2.

- May 5, 4 p.m.: Livepeer (LPT) to host a Treasury Talk session on Discord.

- Unlocks

- May 2: Ethena (ENA) to unlock 3.10% of its circulating provide price $53.44 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating provide price $13.84 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating provide price $9.85 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating provide price $79.71 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating provide price $62.09 million.

- Token Launches

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences

CoinDesk's Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- May 6-7: Financial Times Digital Assets Summit (London)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s ninth Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- Memecoin discussions are rising, whereas curiosity in layer-1 and layer-2 tokens is declining, signaling a shift towards speculative buying and selling conduct, in response to a Santiment report on Thursday.

- Retail traders are embracing hype-driven shopping for, favoring short-term beneficial properties over fundamentals.

- Market timing could also be off, as traditionally the perfect altcoin entry factors happen when crowd sentiment is low — not when phrases like “altseason” and “bull cycle” are trending, the report mentioned.

- Mentions of “buying crypto” have spiked, particularly on dips, suggesting widespread eagerness and doubtlessly untimely confidence.

- Overconfident markets usually face sharp corrections, particularly when merchants anticipate nonstop beneficial properties.

- As May begins, it stays to be seen if this altcoin surge is sustainable or just one other hype-driven blip.

Derivatives Positioning

- BTC's present ascent seems structurally fragile, with a -$30 million liquidity delta throughout the 1% order guide regardless of a 2.7% worth rise because the begin of the month, CoinGlass knowledge present.

- This discount in top-of-book liquidity as the value climbs leaves a thinner order guide with an growing the danger of slippage and volatility if momentum stalls.

- Liquidation heatmaps reveal sizable clusters at $97.6K ($67 million) and $96.1K ($58 million), reinforcing these zones as potential inflection factors for intraday, volatility-driven reversals or stop-driven extensions.

- Binance funding charges present a pointy divergence in sentiment throughout main tokens, with APT, TON, UNI and XRP hitting +10.95% APR, whereas USDE (-29.73%), BNB (-19.06%), and SUI (-10.26%) replicate extra intensive short-side strain, Velo knowledge exhibits.

- The focus of elevated funding amongst giant caps signifies directional lengthy bias, whereas deeply unfavourable charges in choose altcoins counsel both event-driven shorts or systematic derisking.

- Open-interest (OI) rotation is flowing into low-cap, area of interest property; with PUNDIX (+191%) and HAEDAL (+157%) main 24-hour OI beneficial properties, in response to Velo knowledge. As open curiosity broadens out, market sensitivity to catalysts might enhance throughout low to mid-cap tokens.

Market Movements

- BTC is up 2.27% from 4 p.m. ET Thursday at $96,817.27 (24hrs: +0.54%)

- ETH is up 1.48% at $1,822.64 (24hrs: -0.82%)

- CoinDesk 20 is up 1.39% at 2,781.37 (24hrs: -0.32%)

- Ether CESR Composite Staking Rate is down 9 bps at 2.958%

- BTC funding charge is at -0.0093% (-10.2251% annualized) on Binance

- DXY is down 0.51% at 99.74

- Gold is up 0.62% at $3,258.47/oz

- Silver is unchanged at $32.38/oz

- Nikkei 225 closed +1.04% at 36,830.69

- Hang Seng closed +1.74% at 22,504.68

- FTSE is up 0.75% at 8,560.68

- Euro Stoxx 50 is up 1.48% at 5,236.81

- DJIA closed on Thursday +0.21% at 40,752.96

- S&P 500 closed +0.63% at 5,604.14

- Nasdaq closed +1.52% at 17,710.74

- S&P/TSX Composite Index closed -0.19% at 24,795.55

- S&P 40 Latin America closed -0.25% at 2,523.42

- U.S. 10-year Treasury charge is up 8 bps at 4.23%

- E-mini S&P 500 futures are up 0.47% at 5,649.50

- E-mini Nasdaq-100 futures are up 0.33% at 19,935.75

- E-mini Dow Jones Industrial Average Index futures are up 0.47% at 41,045.00

Bitcoin Stats

- BTC Dominance: 64.85 (+0.16%)

- Ethereum to bitcoin ratio: 0.1886 (-1.0%)

- Hashrate (seven-day shifting common): 847 EH/s

- Hashprice (spot): $49.98

- Total Fees: 5.51 BTC / $533,450.65

- CME Futures Open Interest: 141,430 BTC

- BTC priced in gold: 29.8 oz

- BTC vs gold market cap: 8.46%

Technical Analysis

- Ether has reclaimed its earlier swing low, with the $1,750 degree now performing as a key assist zone.

- On the every day timeframe, worth motion is compressing between the 20- and 50-day exponential shifting averages — a setup that always precedes a directional breakout.

- Assuming bitcoin stays in consolidation close to its present resistance, ether has room to push increased, doubtlessly retesting the prior vary low round $2,100, which aligns with the 100-day EMA, including additional proof for this as a goal.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $381.6 (+0.39%), up 1.37% at $386.82 in pre-market

- Coinbase Global (COIN): closed at $201.3 (-0.78%), up 0.56% at $202.42

- Galaxy Digital Holdings (GLXY): closed at $24.05 (+9.72%)

- MARA Holdings (MARA): closed at $14.05 (+5.09%), down 0.14% at $14.03

- Riot Platforms (RIOT): closed at $7.77 (+7.32%), down 1.93% at $7.62

- Core Scientific (CORZ): closed at $8.55 (+5.56%), up 0.58% at $8.60

- CleanSpark (CLSK): closed at $8.67 (+6.12%), up 0.69% at $8.73

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.59 (+6.65%)

- Semler Scientific (SMLR): closed at $33.33 (+3.09%)

- Exodus Movement (EXOD): closed at $40.38 (+3.43%), up 4.95% at $42.38

ETF Flows

Spot BTC ETFs:

- Daily internet move: $422.5 million

- Cumulative internet flows: $39.53 billion

- Total BTC holdings ~ 1.15 million

Spot ETH ETFs

- Daily internet flows: $6.5 million

- Cumulative internet flows: $2.51 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

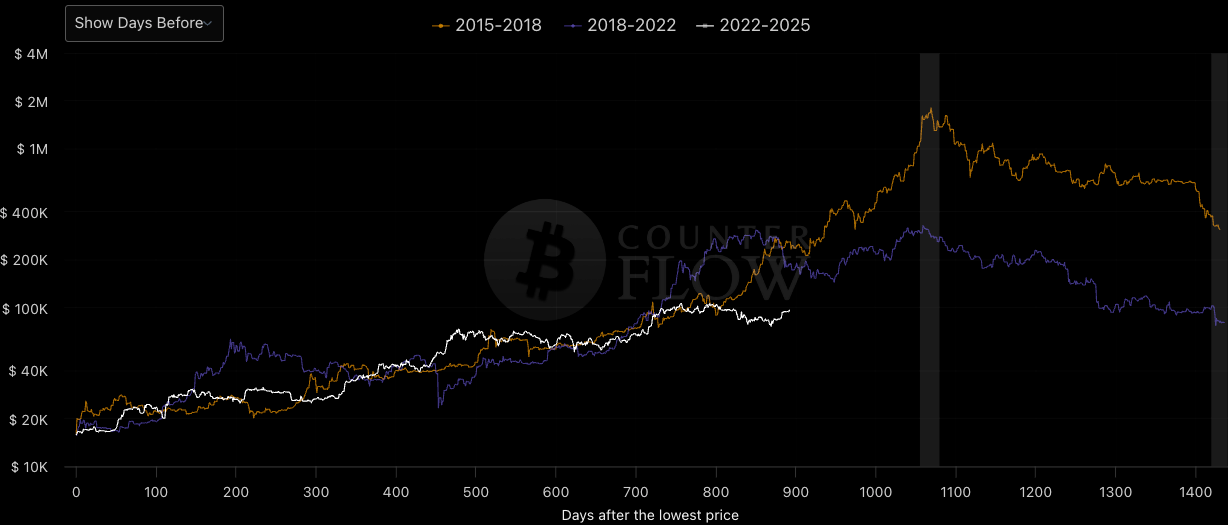

- Data from BitcoinCounterFlow evaluating BTC's efficiency from the underside of every of the final three cycles suggests the highest isn't in but.

- If historical past is any information, the present trajectory round day 700–800 implies we’re coming into a section that would grow to be the steep rally seen in prior cycles.

- The smoother rise this time could also be a mirrored image of the elevated institutional participation within the cryptocurrency ecosystem.

While You Were Sleeping

- Movement Labs Suspends Rushi Manche Amid Coinbase Delisting, Token-Dumping Scandal (CoinDesk): Co-founder Manche was suspended after Coinbase delisted MOVE following experiences {that a} market maker tied to Web3Port dumped over 5% of the token’s provide, triggering a crash.

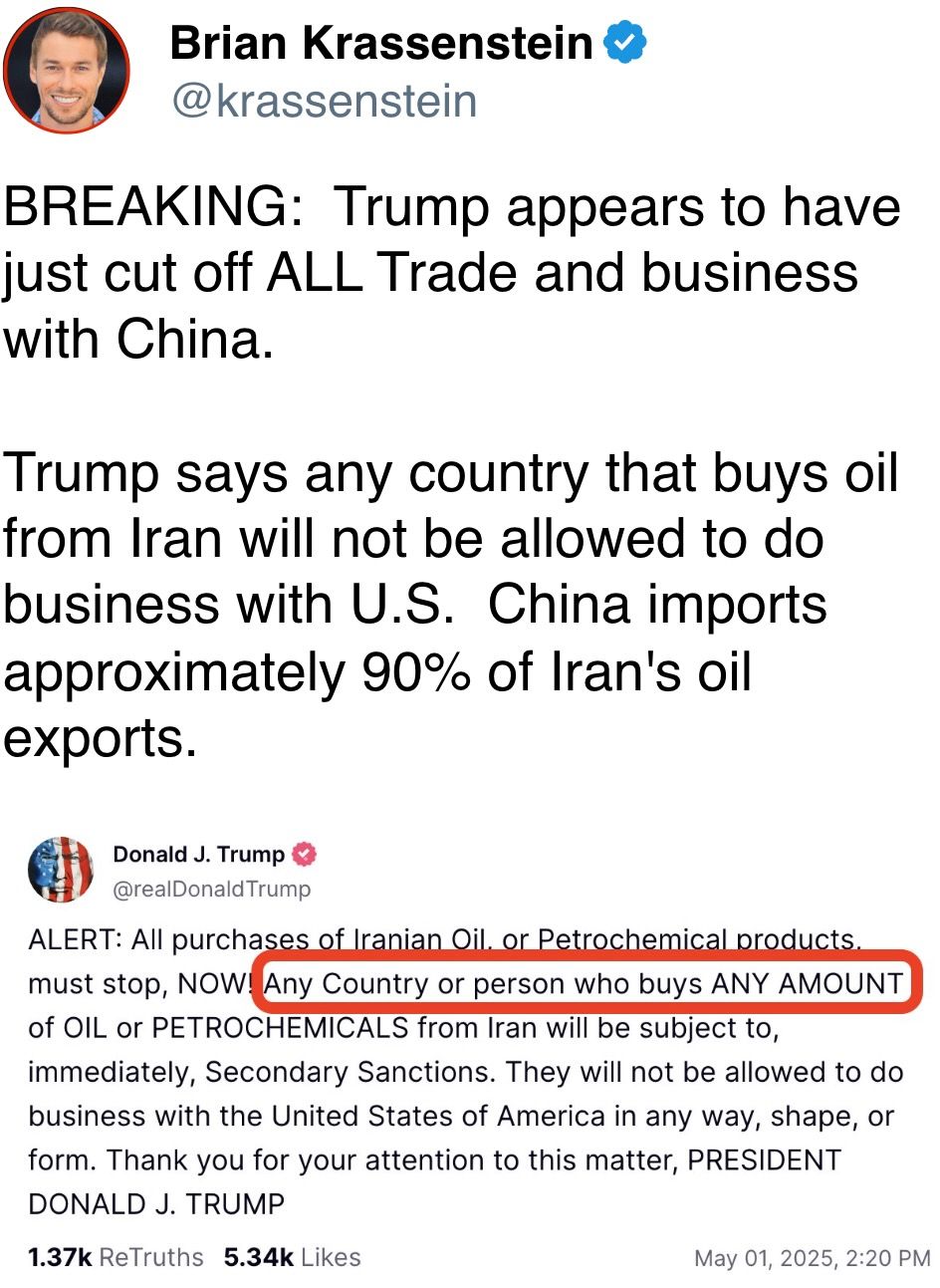

- China Is Considering Trade Talks With U.S., however It Has Conditions (The New York Times): China's Commerce Ministry mentioned it gained’t enter commerce talks until U.S. tariffs are dropped, calling their removing the one method to display sincerity and rebuild belief.

- Metaplanet Issues $25M Bonds to Buy More Bitcoin (CoinDesk): EVO FUND bought 3.6 billion yen ($24.8 million) of zero-coupon debt from Metaplanet, which intends to purchase extra bitcoin after not too long ago exceeding 5,000 BTC.

- UK’s FCA Seeks Public and Industry Views on Crypto Regulation (CoinDesk): The Financial Conduct Authority is looking for suggestions on staking, lending, intermediaries and decentralized finance.

- How China Is Quietly Diversifying From US Treasuries (Financial Times): China is reallocating reserves into gold, mortgage-backed securities and property managed in locations like Hong Kong, lowering reliance on dollar-denominated property that could possibly be sanctioned or frozen.

- Eurozone Inflation Holds Above Target as ECB Weighs Cuts (Bloomberg): Eurozone inflation held regular at 2.2% in April, defying expectations of a slowdown, whereas core inflation jumped to 2.7%.

In the Ether