Now Reading: GST kitty grows 12.6% to scale new high in April

-

01

GST kitty grows 12.6% to scale new high in April

GST kitty grows 12.6% to scale new high in April

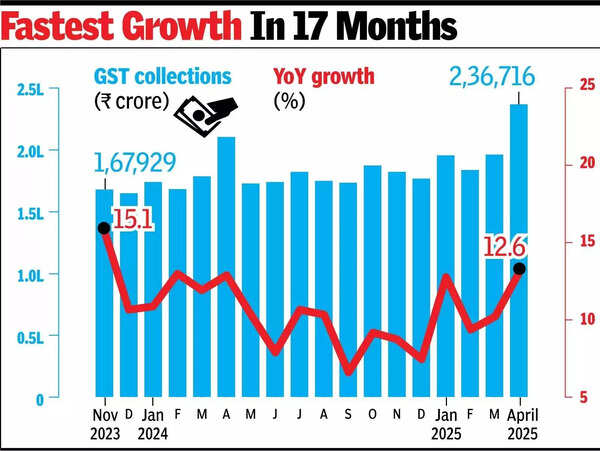

New Delhi: GST collections grew by 12.6% – the quickest tempo of growth in 17 months – to attain a file Rs 2,36,716 crore in April, buoyed by an over 20% soar in mop-up from imports.

Collections from home sources have been 10.7% larger at somewhat underneath Rs 1.9 lakh crore, whereas gross import income rose to Rs 47,000 crore, up 20.8%. Refunds soared 48.3% to Rs 27,341 crore.On a web foundation, collections rose 9% to Rs 2,09,376 crore.

GST figs present economic system’s resilience: FM

Appreciating the efforts of officers, finance minister Nirmala Sitharaman mentioned, “The figures showcase the resilience of Indian economyand effectiveness of cooperative federalism. Deepest gratitude to the taxpayers whose contributions and faith in the GST architecture drive the nation’s progress. Their contributions reflect a shared commitment to building a Viksit Bharat. Congratulations and sincere regards to the dedicated efforts finance ministers of all states and state GST authorities, who remain equal partners in India’s GST framework.”

Collections in April, based mostly on transactions in March, are usually the best as firms rush to meet year-end targets. “The record GST collections underscore the Indian economy’s underlying strength in the face of global economic uncertainties. Govt’s proactive measures to accelerate exports and other GST refunds have eased the working capital burden on industries, a benefit likely to translate to consumers over the medium to long term.The notable GST figures for April may have also been positively influenced by substantial exports to the US market prior to the announcement of reciprocal tariffs. While a potential moderation in absolute GST collections is anticipated next month due to the current global economic climate, the overall outlook for the Indian economy remains optimistic,” mentioned EY India tax associate Saurabh Agarwal.

Experts additionally drew consolation from the expansion being evenly unfold out. Meghalaya reported an enormous 50% soar in collections, whereas Andhra Pradesh, with a 3% decline, was on the different finish of the spectrum.

“Collections have been uniformly high in all major producing/ consuming states and have been in the range 11% to 16%… It is interesting to note that there are more than five states, including UP, Gujarat, Maharashtra, Karnataka and Tamil Nadu, having more than 10 lakh GST registrations… These states account for the bulk of the GST collections,” mentioned MS Mani of Deloitte India.