Now Reading: ‘India is somewhat insulated…’: Fitch sees India GDP growth at 6.5% in FY26 amidst US tariff policies

-

01

‘India is somewhat insulated…’: Fitch sees India GDP growth at 6.5% in FY26 amidst US tariff policies

‘India is somewhat insulated…’: Fitch sees India GDP growth at 6.5% in FY26 amidst US tariff policies

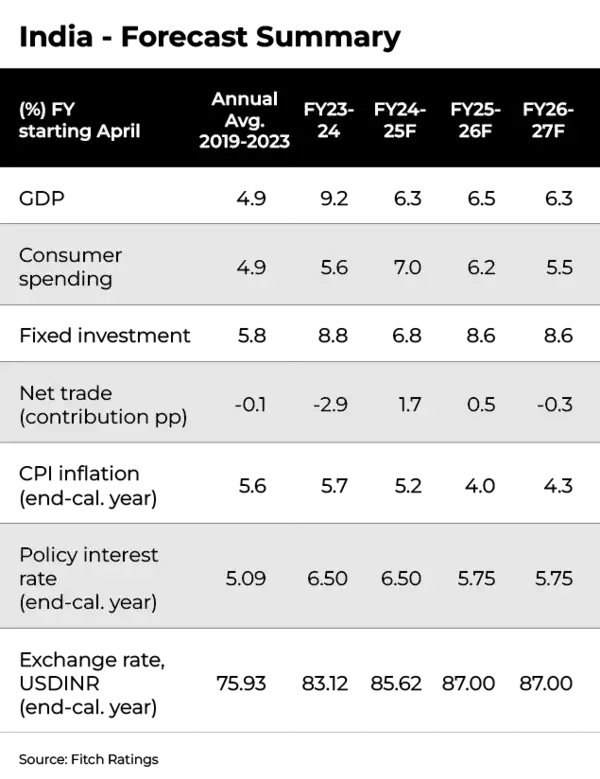

The Indian economic system is ‘somewhat insulated’ from the influence of excessive US tariffs, Fitch has stated in its newest Global Economic Outlook report. Fitch sees the Indian economic system rising at 6.5% in the upcoming monetary yr, with a slight decelerate in the following yr.

“We expect overall GDP growth of 6.5% in FY25-26 and a slight slowdown in growth in FY26-27, to 6.3%. More aggressive-than-expected US trade policies are an important risk to our forecast, though India is somewhat insulated given its low reliance on external demand,” Fitch stated in its report.

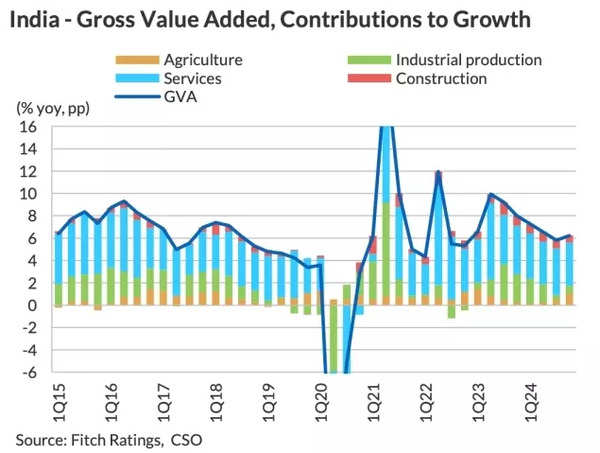

Economic growth rebounded to six.2% in 4Q24 in comparison with 5.4% in 3Q24, supported by elevated personal and public expenditure, together with funding spending. Agricultural contribution has strengthened all through the fiscal yr, benefiting from beneficial monsoon circumstances that enhanced kharif crop yields, notes the report.

India GDP growth forecast

Fitch expects India’s GDP growth to strengthen additional in 1Q25, aligning with its projection of 6.3% growth for the fiscal yr ending March 31, 2025 (FY24-25).

Corporate sentiment stays optimistic, with banking surveys indicating sustained double-digit growth in personal sector credit score. The Union Budget maintains substantial public infrastructure funding, while sustaining a broadly impartial stance on growth. These components, mixed with lowered capital prices, help Fitch’s forecast of elevated funding exercise for FY25-26 and FY26-27.

Also Read | Trump tariffs influence: Is a US recession seemingly and does India want to fret about it?

Consumer sentiment has proven a slight decline lately, accompanied by a notable discount in vehicle purchases. However, declining inflation charges will improve actual earnings ranges, while employment indicators from official sources and PMI surveys counsel regular job creation and workforce participation growth, Fitch famous.

India GVA – Contributions to growth

Additionally, the funds’s revisions to tax-free allowances and tax brackets will improve disposable incomes. These elements will maintain shopper expenditure, although at a extra modest tempo than the present yr.

“Moreover, the budget raised tax-free income allowances and revised tax brackets, which will raise posttax incomes. These factors will support consumer spending growth, albeit at a slower rate than this year,” Fitch stated.

India’s GDP growth has benefited from internet exports this yr, pushed by sturdy export efficiency and decreased imports. This pattern is anticipated to stabilise, with internet exports more likely to have a impartial influence on growth throughout FY25-26 and FY26-27, it added.

Also Read | Donald Trump’s tariffs: India could also be amongst least susceptible Asian economies in commerce battle with US – however there is a catch!

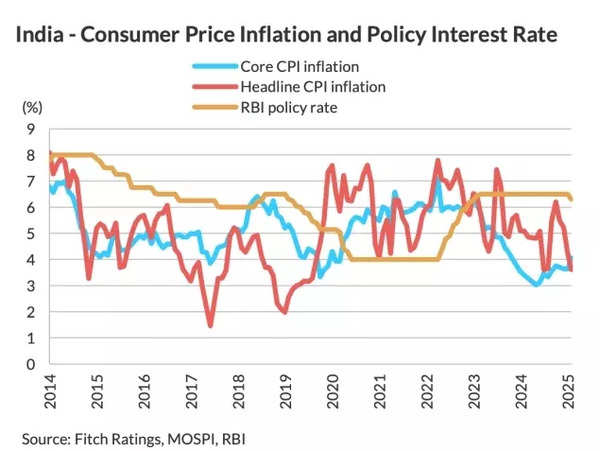

Consumer worth inflation decreased to three.6% in February from January’s 4.3%, primarily resulting from lowered meals worth inflation. Food worth developments in upcoming months are anticipated to facilitate a gradual discount in headline inflation to 4.0% by end-2025, adopted by a modest improve to 4.3% by December 2026.

CPI & Policy fee prediction

The RBI initiated financial easing in early February, lowering the repo fee by 25bp to six.25%. Two further coverage fee reductions are anticipated this calendar yr, with the speed projected to succeed in 5.75% by December 2025, adjusted downward from the earlier GEO’s forecast of 6.25%, Fitch concluded.