Now Reading: Indians rush to buy the dip on Wall Street amid market chaos

-

01

Indians rush to buy the dip on Wall Street amid market chaos

Indians rush to buy the dip on Wall Street amid market chaos

MUMBAI: In April, as US President Donald Trump rattled international markets along with his tariff hike proposals for nearly all its buying and selling companions, Indians investing in equities listed overseas, particularly in the US, confirmed their sensible acumen. They doubled down on investments overseas by the month, principally shopping for US shares as markets crashed, a method popularly referred to as ‘shopping for the dip’ in market parlance.

“April was a record-breaking month for us, with both new and existing investors showing strong conviction in building exposure to US and global equities,” mentioned Nikhil Behl, co-founder & CEO – shares, INDMoney, a tech-driven platform for Indians to put money into shares, each regionally and globally.

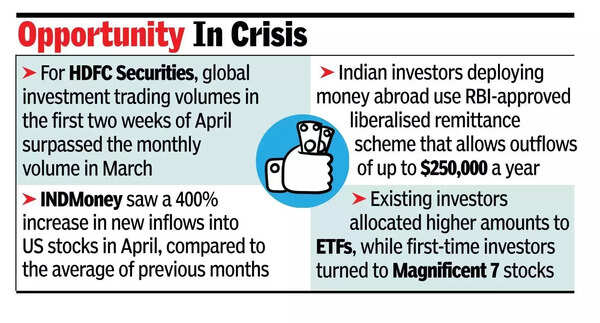

The platform noticed a 400% enhance in new inflows into US shares in April, in contrast to the common of the earlier a number of months, Behl mentioned. “This month, the platform added almost as many new US stock investors as Indian stock investors – a trend we have never seen before!” mentioned Behl.

Although no industry-wide information for Indians investing in shares listed overseas can be found, the development throughout platforms that facilitate home buyers to make investments overseas was related. For HDFC Securities, in the first two weeks itself, buying and selling volumes in international investing surpassed the month-to-month quantity in March. “We have seen a significant uptick in both user activity and investment volumes following the recent tariff announcements,” mentioned Abhishek Mehrotra, Head Equities & Investment Products, HDFC Securities.

For Appreciate, one other platform in the similar section, “there was a 2.5x increase in average stock purchases and a 2x increase in average stock purchase value per user in the period following tariff announcements compared to the previous period,” mentioned Shlok Srivastav, COO & co-founder of the platform.

Indian buyers use the RBI-approved liberalised remittance scheme(LRS) that permits every resident Indian to make investments up to $250,000 every year to put cash in equities listed in international exchanges. Such enthusiasm by home buyers, in accordance to Behl, was primarily as a result of they noticed the market volatility as a first-rate shopping for alternative, particularly in innovation-led sectors like AI, semiconductors, and large-cap tech. “Well-known names like Apple, Google, and Meta are now available at far more attractive valuations.With capital still on the sidelines, many retail investors viewed this as the right moment to deploy.”

Such investments by Indians weren’t concentrated, which is one other signal of a matured investing method. While some purchased into the Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla), there was substantial shopping for curiosity for exchange-traded funds. Most current US inventory buyers had been seen spreading their dangers by allocating larger quantities to ETFs, whereas first-time buyers principally purchased shares from the Magnificent 7 pack, Behl of INDMoney mentioned.