Now Reading: SOL Hovers Near $154 After Support Break as Liquidations Rise

-

01

SOL Hovers Near $154 After Support Break as Liquidations Rise

SOL Hovers Near $154 After Support Break as Liquidations Rise

Solana (SOL) stays below strain as macroeconomic headwinds—notably renewed tariff issues — rattle investor confidence.

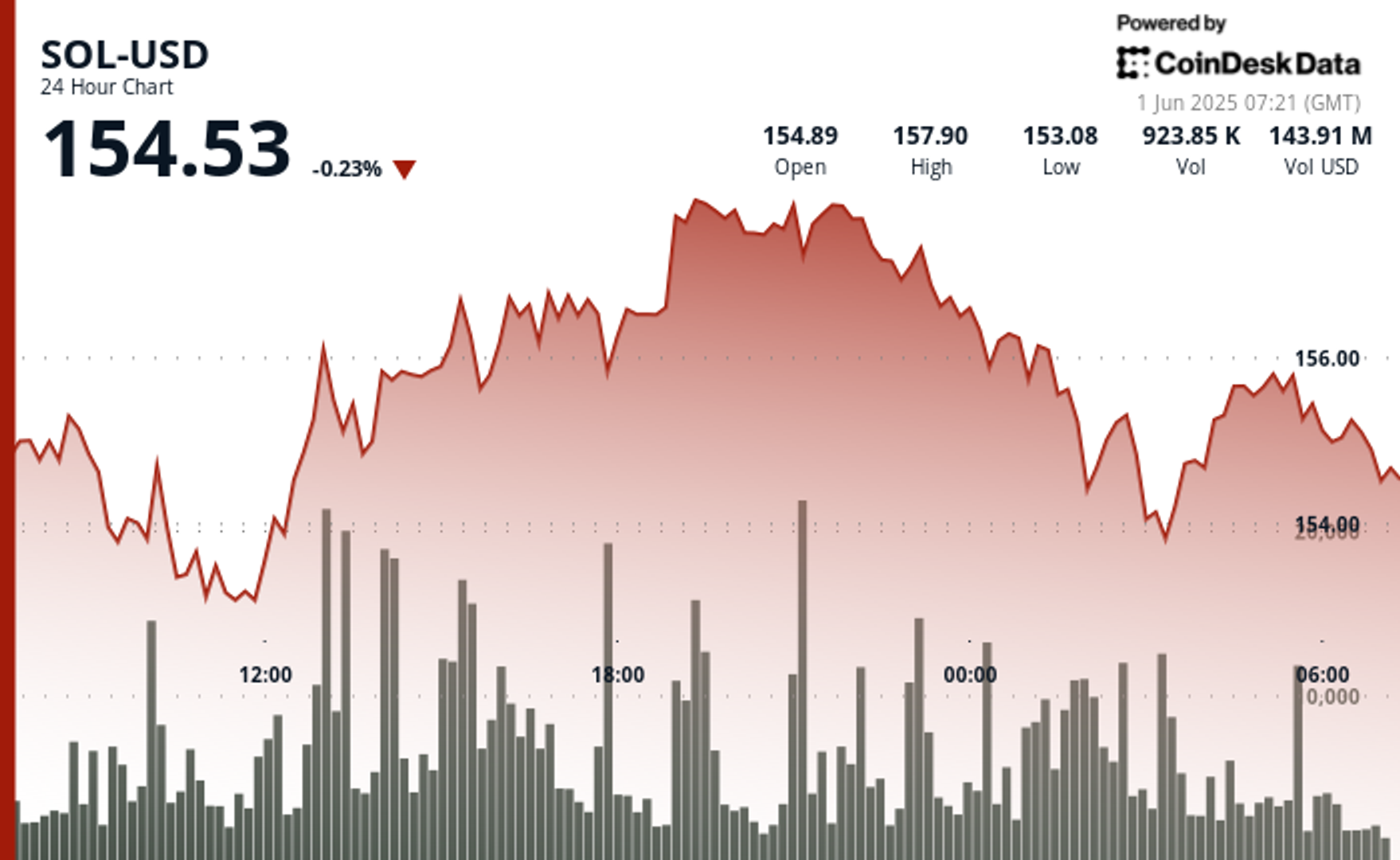

The token is now hovering round $154.50 after establishing a decent buying and selling vary between $152.33 and $158.06, reflecting a 3.76% swing previously 24 hours, in response to CoinDesk Research’s technical evaluation knowledge mannequin.

Although greater lows had beforehand urged resilience, SOL slipped from $156.74 to $154.86 in a single hour, breaking beneath its mid-April uptrend channel.

Derivatives knowledge displays bearish sentiment: open curiosity in SOL futures is down 2.47% to $7.19 billion, whereas lengthy liquidations surged to $30.97 million, indicating strain on leveraged positions. Short liquidations stay minimal, reinforcing the draw back bias.

Still, institutional curiosity stays evident. Circle’s current $250 million USDC mint on Solana has added liquidity and cemented the chain’s stablecoin management, with 34% of all stablecoin quantity now routed by the community. Additionally, SOL Strategies’ $1 billion validator fund indicators sustained long-term confidence within the protocol’s scalability, even as short-term worth motion falters.

Technical Analysis Highlights

- SOL established a 5.73-point vary ($152.33–$158.06), indicating a 3.76% intraday swing.

- Earlier worth motion traced a transparent ascending channel with stable help close to $152.80, supported by heavy accumulation.SOL hit a session excessive of $158.06 through the 19:00 hour on sturdy quantity, signaling earlier bullish momentum.

- A reversal unfolded within the early morning hours, with SOL falling from $156.74 to $154.86 on elevated promoting.Selling strain peaked between 01:53–01:54, with over 74,000 items traded in a pointy burst.

- Short-term momentum turned bearish as decrease highs and weaker quantity outlined the ultimate buying and selling stretch.As of writing, SOL is consolidating close to $154.50, suggesting worth stability however with draw back danger if quantity doesn’t enhance.

External References