Now Reading: Stock market crash: LIC’s stock portfolio takes a Rs 1.5 lakh crore hit in 2025 as markets bleed

-

01

Stock market crash: LIC’s stock portfolio takes a Rs 1.5 lakh crore hit in 2025 as markets bleed

Stock market crash: LIC’s stock portfolio takes a Rs 1.5 lakh crore hit in 2025 as markets bleed

Stock market crash influence: Life Insurance Corporation of India (LIC), the nation’s largest home institutional investor, has skilled a substantial decline of Rs 1.45 lakh crore in its fairness portfolio worth inside two months of 2025. The worth decreased from Rs 14.9 lakh crore in December 2024 to Rs 13.4 lakh crore by February’s finish, representing one of the vital vital mark-to-market losses in its latest historical past for its numerous 310-stock portfolio.

According to an ET evaluation, the extreme decline in LIC’s investments instantly correlates with the general market crash, significantly affecting small and mid-cap shares, which have skilled their most vital decline for the reason that COVID-19 disaster. Large-cap shares, the place LIC maintains appreciable investments, have additionally skilled substantial losses.

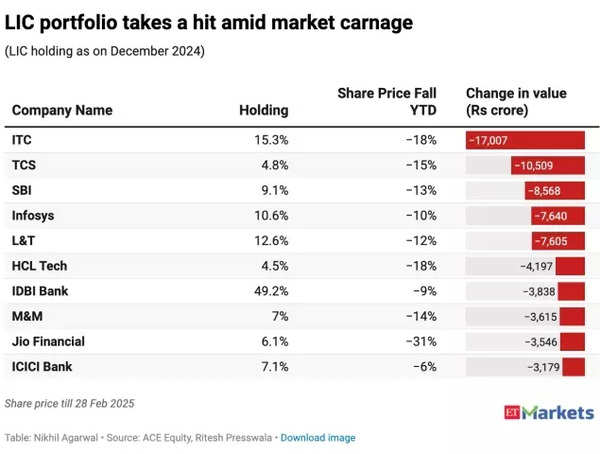

ITC, LIC’s second-largest fairness funding, has contributed considerably to the portfolio’s decline, with an 18% lower ensuing in roughly Rs 17,000 crore worth discount. Technology corporations TCS and Infosys, the place LIC maintains 4.75% and 10.58% possession respectively, have declined, lowering the portfolio worth by Rs 10,509 crore and Rs 7,640 crore, in keeping with ACE Equity information.

LIC Portfolio takes a hit

In the banking sector, LIC’s substantial investments in SBI (9.13% stake) and ICICI Bank (7.14% stake) decreased by Rs 8,568 crore and Rs 3,179 crore respectively. Jio Financial Services recorded a 30.5% decline, lowering LIC’s funding worth by Rs 3,546 crore. Additional vital decreases had been noticed in L&T, HCL Tech, M&M, Jio Financial, ICICI Bank, Adani Ports and JSW Energy, with most experiencing double-digit proportion losses this yr.

Also Read | ‘You are better off…’: Zerodha’s Nithin Kamath shares SIP mantra amidst stock market crash doom and gloom

LIC maintains fairness positions in greater than 310 corporations with minimal 1% possession stakes, with widespread losses throughout holdings. The decline impacts main monetary establishments, expertise leaders and industrial corporations, reflecting the broader market downturn on Dalal Street.

The insurer has witnessed losses exceeding Rs 1,000 crore in no less than 35 stock positions this yr.

Key holdings in LIC’s portfolio embrace Reliance Industries (₹1,03,727 crore), ITC (₹75,780 crore), Infosys (₹67,055 crore), HDFC Bank (₹62,814 crore), TCS (₹59,857 crore), SBI (₹55,597 crore), and L&T (₹54,215 crore).

Several investments have proven constructive efficiency, together with Bajaj Finance, Kotak Mahindra Bank, Maruti Suzuki, Bajaj Finserv, and SBI Cards, regardless of the general market decline.

The ongoing market instability and chronic promoting stress increase questions on potential additional losses in LIC’s investments. Despite the insurer’s historic resilience to market fluctuations, continued FII promoting and weak spot in small and mid-cap sectors counsel sustained challenges forward.

Also Read | Stock market crash: Mayhem in smallcap and midcap shares! What ought to buyers do?

Analysts notice that Nifty’s 16% decline from peak ranges has introduced its TMM PE a number of under 20 for the primary time in 32 months, indicating extra affordable valuations.

Market restoration relies upon considerably on FII sentiment enchancment. Recent months have seen FIIs promote Indian equities value over Rs 3 lakh crore in the money phase.

Various monetary establishments provide completely different market views. Kotak Institutional Equities anticipates range-bound Nifty motion this yr. Citi Research tasks restoration to 26,000 by December 2025, suggesting 13% potential good points. Morgan Stanley predicts India will outperform rising markets, supported by financial stability and growing consumption.

The market’s ongoing volatility by 2025 will check LIC’s funding technique and its potential to take care of policyholder returns.