Now Reading: Sui (SUI) Price Volatile as 24-Hour Trading Volume Tops 30-Day Average by 11%

-

01

Sui (SUI) Price Volatile as 24-Hour Trading Volume Tops 30-Day Average by 11%

Sui (SUI) Price Volatile as 24-Hour Trading Volume Tops 30-Day Average by 11%

SUI

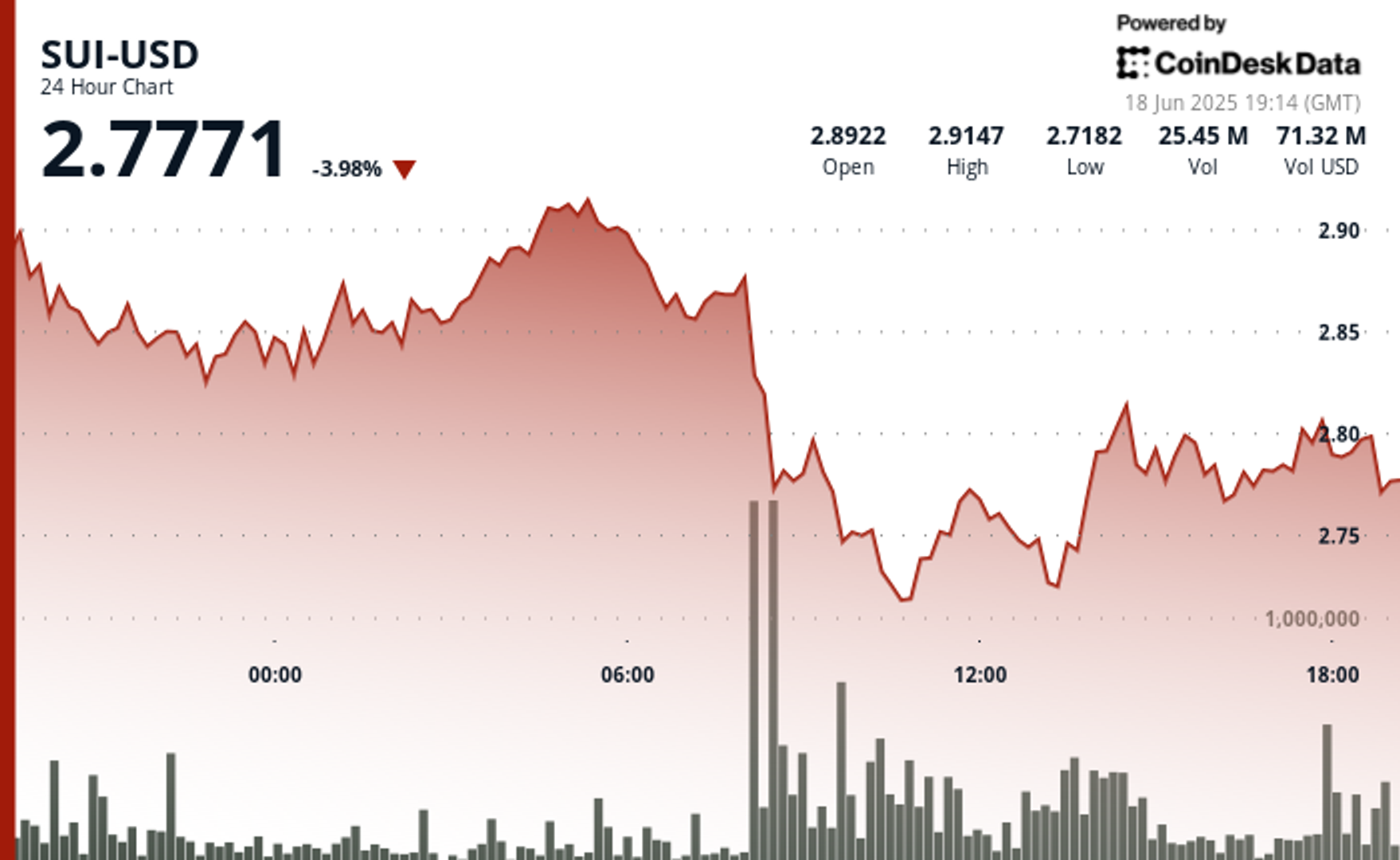

skilled a turbulent 24-hour buying and selling window marked by sharp intraday swings and heavier-than-usual buying and selling exercise.

After initially plunging to $2.71, the token mounted a quick rally towards $2.92 earlier than encountering robust resistance close to $2.82, in line with CoinDesk Research’s technical evaluation mannequin. That zone capped the restoration, triggering a swift reversal that dragged costs again towards the $2.78–$2.79 space.

What made the transfer extra notable was the accompanying surge in 24-hour buying and selling quantity, which spiked 11% above the 30-day common. That stage of participation amplified the volatility, with fast-moving value swings exposing each bulls and bears to whiplash strikes. The rejection from $2.82 and failed makes an attempt to retake that stage set the stage for extra cautious buying and selling within the close to time period, the mannequin confirmed.

Support across the $2.72–$2.75 area proved sturdy, with value bouncing off that vary a number of instances. As quantity cools and consolidation tightens, SUI could enter a ready interval as merchants reassess short-term route following the failed breakout and unusually lively session.

Technical Analysis Highlights

- SUI traded in a 7.3% vary between $2.919 and $2.710 in the course of the 24-hour window.

- Heavy promoting struck at 08:00 as the worth dropped 9.1% from $2.878 to $2.765.

- A bounce try round 18:00 despatched SUI up 1.5% to $2.824 on quantity of 1.4M.

- The rally was instantly reversed, with the worth falling to $2.784 and confirming resistance close to $2.82.

- Support held close to $2.72–$2.75 regardless of a number of assessments and consolidation all through the session.

Disclaimer: Parts of this text have been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Policy.