Now Reading: Trump tariffs: Is China really ready for a trade war with US?

-

01

Trump tariffs: Is China really ready for a trade war with US?

Trump tariffs: Is China really ready for a trade war with US?

Donald Trump is again within the White(Fight) House, and so is his most dependable financial weapon: tariffs, notably centered on China. The newest spherical, a 20% levy on Chinese imports, has despatched Beijing scrambling for a response.

Driving the information

Donald Trump has reignited the US-China trade war with a contemporary spherical of tariffs, elevating duties on Chinese imports to twenty%—citing nationwide safety considerations and China’s function within the fentanyl disaster. Beijing responded swiftly with retaliatory tariffs, elevated army spending, and a warning from its international ministry:

“If war is what the US wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end.”

As anticipated, the tit-for-tat measures have despatched shockwaves by way of international markets, elevating fears of a extended financial battle that might reshape worldwide trade for years to return. Trump, emboldened by his re-election and Republican management of Congress, believes he has the leverage to drive China into submission.

Why it issues

This is extra than simply an financial dispute—it’s a battle for international supremacy. Trump’s aggressive stance goals to dismantle a trade system that he argues has unfairly benefited China for a long time.

Meanwhile, Chinese President Xi Jinping is desperately making an attempt to forestall his nation from struggling the type of financial and geopolitical isolation that doomed the Soviet Union through the Cold War, a Wall Street Journal report mentioned.

It isn’t simply trade. The competing agendas of the leaders of the world’s two largest economies are poised to result in exactly what China is making an attempt to keep away from: a superpower conflict not seen because the Cold War, an all-encompassing rivalry over financial, technological and total geopolitical supremacy.

An article within the WSJ

While each nations have engaged in trade skirmishes earlier than, this time, the stakes are even larger. Trump is pursuing a multi-pronged technique that not solely entails tariffs but additionally export controls, funding restrictions, and efforts to strengthen US trade ties with different nations to isolate China economically.

China’s countermeasures

Xi want to consider that China is best ready this time.

As anticipated, Beijing is getting ready a mixture of short-term and long-term methods to counter the US offensive. In the speedy time period, it has introduced retaliatory tariffs of 10–15% on key US imports, whereas additionally stepping up its push to develop self-sufficiency in expertise and vitality manufacturing.

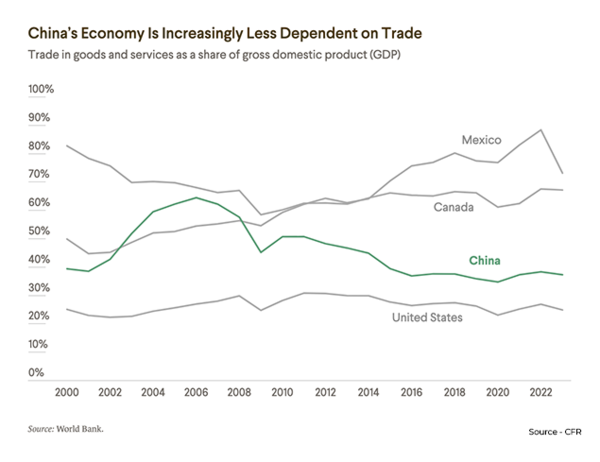

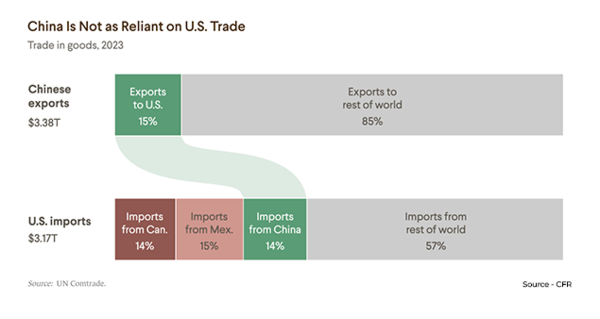

China can be working to strengthen its financial ties with non-Western nations. It has ramped up trade agreements with international locations in Southeast Asia, the Middle East, and Africa, aiming to scale back its reliance on the US market. Additionally, Beijing is lobbying main US firms—lots of which depend on Chinese manufacturing—to push again towards Trump’s tariffs, the WSJ report mentioned.

Is China really ready for a trade war towards US?

On the face of it, China appears a lot ready this time. However, in contrast to the final trade war through the first time period of Trump, China’s financial place has weakened. Years of pandemic-related disruptions, a crumbling actual property sector, and declining international funding have left the nation extra weak to exterior shocks. Its post-pandemic restoration has been sluggish, and home demand stays weak. Xi’s financial workforce has tried to counterbalance this with state-driven investments, however progress stays fragile.

Interestingly, one lesson Xi has discovered from the primary trade war with Trump is that China has extra to lose from hitting again with reciprocal tariffs. The US buys much more from China than the opposite approach round, which means China’s capability to harm the US financial system by way of tariffs alone is restricted. Instead, Beijing is exploring different retaliatory measures, resembling proscribing exports of essential minerals which might be important for US expertise industries.

While Chinese leaders could threaten retaliation, their actual precedence is shoring up financial stability fairly than participating in an all-out trade war.

What they’re saying

- Trump’s trade advisers: “The US can no longer afford to let China dictate global trade rules. We are reclaiming our economic independence.”

- Michael Pillsbury, China professional: “They are kind of desperate. Their economy is in trouble. Now that Trump put the tariffs on, they know this campaign [to avoid them] has failed.”

- Chinese officers: “Xi believes that must be avoided,” mentioned a one who consults Beijing, referring to the danger of Soviet-style isolation.

- US protection secretary

Pete Hegseth : “Those who long for peace must prepare for war. We are strengthening our military to deter China’s aggression.”

Trump’s technique

Even although Trump could be the one who at present seems remoted on the world stage—choosing trade fights with erstwhile allies like Mexico and Canada, alarming Europe over his dealing with of the war in Ukraine and vowing to annex Greenland and the Panama Canal—the reality is that China doesn’t maintain a robust hand.

An article within the WSJ

Trump’s trade coverage is designed not simply to counter China however to rewire the worldwide buying and selling system. His administration believes the US has been disproportionately harmed by free trade agreements that allowed China to flood the market with low cost exports whereas proscribing international entry to its personal financial system.

The newest tariffs are a part of a broader effort to drive China into making structural modifications to its financial system. Trump has additionally pushed Mexico and Vietnam—each key US buying and selling companions—to crack down on Chinese companies that attempt to circumvent tariffs by routing their exports by way of third international locations. His trade workforce is negotiating separate offers with different nations to strengthen US financial alliances earlier than participating instantly with Beijing.

“All the stuff he’s doing is so that we can put more resources to counter China,” an administration official mentioned.

US leverage play

- Trump is just not stopping at tariffs. His administration is weighing extra measures to tighten restrictions on Chinese funding within the US, restrict US corporations’ enterprise operations in China, and impose stricter export controls on high-tech items.

- Trump’s workforce additionally sees a chance to reshape international trade by putting offers with different nations earlier than negotiating with China. The US has been in talks with Mexico, Vietnam, and India to strengthen trade relations and stop China from utilizing third international locations as a backdoor into the US market.

- The stakes prolong past trade. Washington’s push to decouple key industries from China, prohibit expertise transfers, and rally companions towards Beijing’s financial practices suggests a long-term technique of containment. If profitable, these strikes may erode China’s capability to maintain high-growth ranges, advance its technological ambitions, and challenge energy internationally.

Between the traces

- Trump’s trade war is as a lot about politics as it’s about economics. He is betting that his robust stance on China will rally his base, reinforcing his picture as a fighter towards unfair trade practices.

- For China, the problem is existential. Xi Jinping is set to keep away from the destiny of the Soviet Union, which collapsed beneath financial stress from the US and its allies. That means China is prone to double down on efforts to insulate itself from US affect—whether or not by way of technological self-sufficiency, expanded trade partnerships, or army posturing.

- The backside line: The US-China trade war is getting into a new, extra intense part. Trump believes he has the higher hand and is prepared to let China “stew” in financial misery till it concedes to US calls for, the WSJ report mentioned.

(With inputs from companies)