Now Reading: Waning demand anticipated to hit breakneck rally in India’s auto shares | Information on Markets

-

01

Waning demand anticipated to hit breakneck rally in India’s auto shares | Information on Markets

Waning demand anticipated to hit breakneck rally in India’s auto shares | Information on Markets

&w=826&resize=826,465&ssl=1)

Over the previous 12 months, the NSE Nifty Auto Index has jumped 66 per cent in contrast with a 26 per cent rise within the broader benchmark. Photograph: Bloomberg

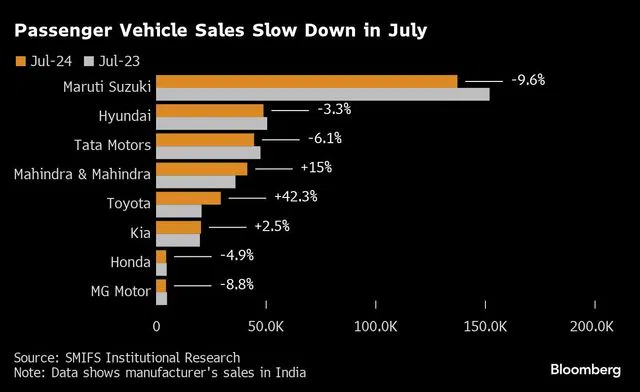

A scorching rally in India’s auto shares is reversing as a construct up of unsold automobiles and rising reductions by carmakers strain revenue margins.

India’s NSE Nifty Auto Index is down 4.1 per cent in August, greater than double the decline within the Nifty 50 Index. Bellwether Maruti Suzuki India Ltd. has slid 6 per cent to date within the month, on monitor for its worst month-to-month efficiency since December 2022.

)

“After such a run up there’s threat that these firms will see correction,” mentioned Manu Rishi Guptha, a portfolio supervisor at MRG Capital.

Over the previous 12 months, the NSE Nifty Auto Index has jumped 66 per cent in contrast with a 26 per cent rise within the broader benchmark.

The slowdown has prompted some carmakers to supply incentives to take care of market share. Final month, Maruti Suzuki mentioned it raised low cost choices amid “lower than ultimate market circumstances.” Earlier this month, Mahindra & Mahindra executives described trade demand and atmosphere as “tepid”.

)

There are nonetheless some comparatively safer pockets of the auto market. “We’re presently extra inclined towards two-wheelers over four-wheelers,” mentioned Deepika Mundra, an analyst at M&G Investments. Two-wheeled motor automobiles are higher positioned to realize from the transition to electrical automobiles as a result of greater market penetration, she added.

Nonetheless, the extremely anticipated itemizing of Hyundai Motor Co.’s India unit might create a further overhang within the sector as traders acquire an alternative choice, Mundra mentioned. The South Korean agency is ready to boost a document sum of money within the nation in what may very well be the India’s largest preliminary public providing to this point.

The market’s subsequent take a look at might be in the course of the pageant season beginning late subsequent month, a excessive season for auto gross sales. Final 12 months’s 42-day season noticed document car gross sales, with practically 550,000 automobiles being offered within the interval. That’s was about 10 per cent greater than the 12 months prior.

Nonetheless, expectations usually are not excessive for a serious turnaround. Demand for entry degree automobiles is seeing little uptick and carmakers are dumping extra inventory forward of the season, mentioned Amit Hiranandani, an analyst at Smifs Ltd.

“Seller confidence means that the upcoming pageant season gross sales could also be flat or decrease in comparison with final 12 months,” he added.

First Revealed: Aug 19 2024 | 8:53 AM IST

&w=1024&resize=1024,1024&ssl=1)