The story to date: A current report by the World Bank has generated vital debate with regard to the true image of inequality in the Indian financial system. The report outlined a quantity of salutary outcomes; not solely had excessive poverty lowered drastically, inequality had lowered too. The Gini coefficient — a measure of inequality that ranges from 0 to 1, with 1 indicating excessive inequality — had fallen from 0.288 in 2011-12 to 0.255 in 2022-23, making India an financial system with one of the lowest ranges of inequality in the world.

What adopted?

This discovering was highlighted by the authorities as a vindication of its progress insurance policies and financial administration. However, as a lot of commentators have identified, the details highlighted by the World Bank don’t present a real image of inequality in the nation. While inequality in consumption could also be low — which is in itself a contested truth — revenue and wealth inequality in India are extraordinarily excessive and have elevated over time, making India one of the most unequal economies in the world.

What is consumption inequality?

The inequality figures detailed by the World Bank should not of revenue or wealth, however of consumption. This is problematic for a number of causes. First, inequality in consumption will at all times be decrease than inequality in wealth or revenue. A poorer family will spend a majority of its revenue on the requirements of life, and may have little or no financial savings. If its revenue doubles, consumption spending won’t double, since the family will now have the ability to avoid wasting quantity of its revenue; its consumption ranges won’t rise in the identical proportion as their incomes. Thus, consumption inequality will at all times be lower than revenue or wealth inequality.

Also Read: Does inequality result in progress? | Explained

Second, there are particular issues with the use of databases for the calculation of inequality. Data on consumption spending comes from the Household Consumption Expenditure Surveys (HCES) of 2011-12 and 2022-23. These surveys could present correct info on low ranges of expenditure, however are unable to seize extraordinarily excessive incomes, thus offering an under-estimation of inequality. Furthermore, there have been vital methodological adjustments between the two surveys that render them incompatible, and don’t permit for a comparability of inequality ranges over time. This has been identified not simply by a number of researchers, however the official launch of the HCES for 2022-23 additionally cautions in opposition to easy comparisons.

What are the ranges of revenue and wealth inequality?

The low Gini talked about by the World Bank, due to this fact, pertains to consumption inequality, and can’t be in comparison with ranges of revenue inequality worldwide. What is the true degree of revenue inequality?

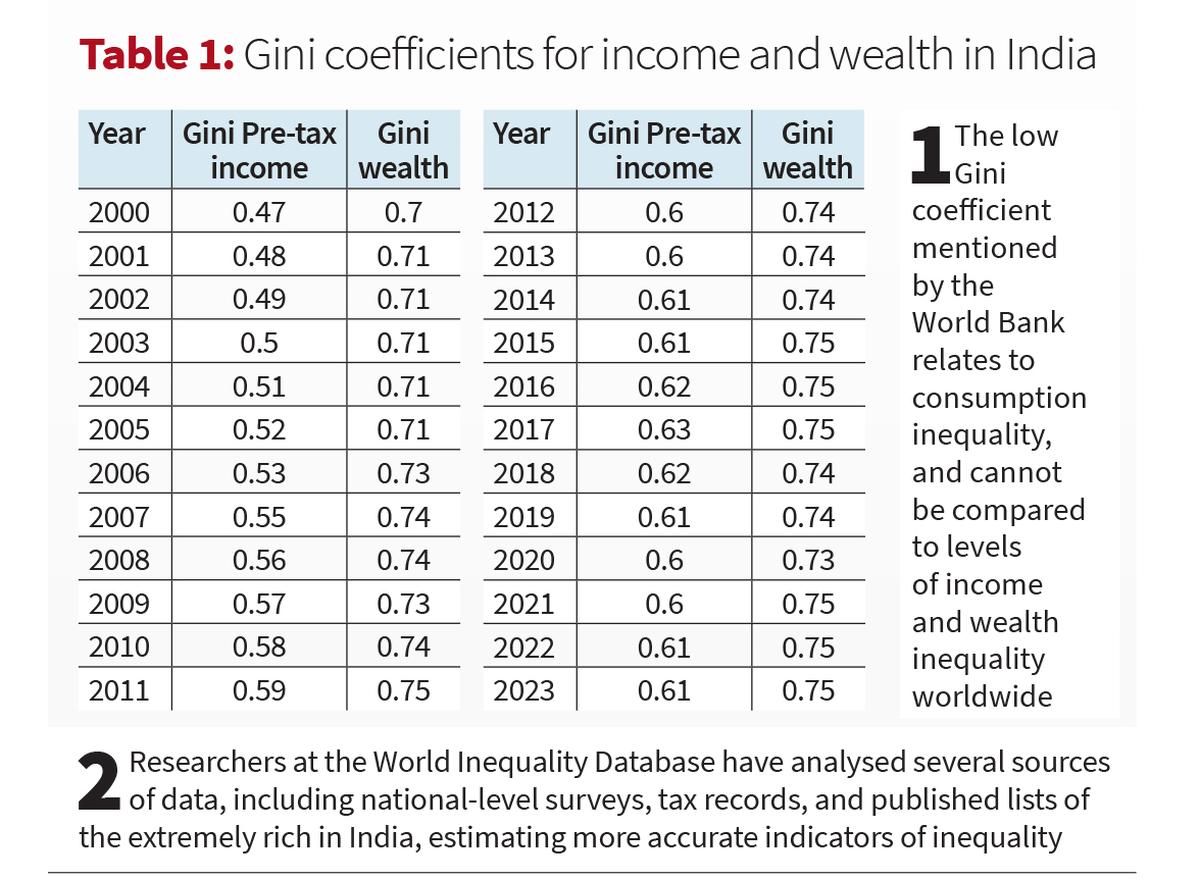

Calculating the precise degree of revenue and wealth inequality in India is extraordinarily tough, since official surveys are likely to miss out on extraordinarily excessive ranges of revenue and wealth. However, researchers at the World Inequality Database (WID), led by Thomas Piketty, have analysed a number of sources of information, together with national-level surveys, tax data, and printed lists of the extraordinarily wealthy in India, estimating extra correct indicators of inequality. These estimates present a extra sobering have a look at the state of inequality in India.

The Gini coefficient for pre-tax revenue for India in 2022-23 is 0.61; out of 218 economies thought of in the WID, there are 170 economies with a decrease degree of inequality, making India one of the most unequal economies in the world. The image is not significantly better when contemplating wealth inequality. India’s Gini coefficient for wealth inequality is 0.75, implying that wealth is much more concentrated than revenue or consumption. Even although wealth Gini is excessive, different nations have far higher wealth concentrations; there are 67 nations with a decrease wealth Gini than India.

As proven in the figures in Table 1, the Gini coefficient for revenue has proven a big rise, from 0.47 in 2000 to 0.61 in 2023. Wealth inequality has risen in a decrease proportion, solely as a result of ranges of wealth inequality have been so excessive to start with. The Gini for wealth inequality rose from 0.7 in 2000 to 0.75 in 2023. Either approach, the image of low and falling inequality as outlined by the World Bank doesn’t characterise the present actuality of India.

In truth, the use of the Gini understates the sheer focus of wealth occurring in India right now. The Gini coefficient is an mixture measure, and takes under consideration the whole vary of observations. It doesn’t present info on the relative share of wealth or revenue held by a fraction of the inhabitants. When contemplating wealth focus of the high 1%, India emerges as one of the most unequal economies in the world. According to information from the WID, in 2022-23, the high 1% of adults in India managed virtually 40% of internet private wealth. There are solely 4 economies with a better degree of wealth focus — Uruguay, Eswatini (Swaziland), Russia and South Africa.

Is a discount in consumption inequality on anticipated strains?

The story over the previous few a long time is one of rising incomes and inequality, and never a discount. In truth, a discount in consumption inequality is not sudden in such a state of affairs. As incomes rise, assuming that there is no fall in actual incomes of the poor (an end result which some authors similar to Utsa Patnaik assert has really occurred), the consumption of the poor would rise in a higher proportion than center and higher courses, who would have the ability to save far more out of their rising incomes. The greater incomes of higher courses would permit for higher ranges of saving, which might then be remodeled into higher ranges of wealth. Consumption inequality can cut back even when revenue inequality and wealth inequality rise; all these outcomes characterise the Indian financial system right now. What is of significance is the excessive focus of incomes and wealth which have accompanied progress in India right now, making it one of the most unequal economies in the world, an end result that has penalties for future progress prospects of the financial system.

Rahul Menon is Associate Professor in the Jindal School of Government and Public Policy at O.P. Jindal Global University.