Now Reading: XRP Falls 8% Below $3 After Hitting Resistance, High-Volume Selloff Signals Weakness

-

01

XRP Falls 8% Below $3 After Hitting Resistance, High-Volume Selloff Signals Weakness

XRP Falls 8% Below $3 After Hitting Resistance, High-Volume Selloff Signals Weakness

What to Know

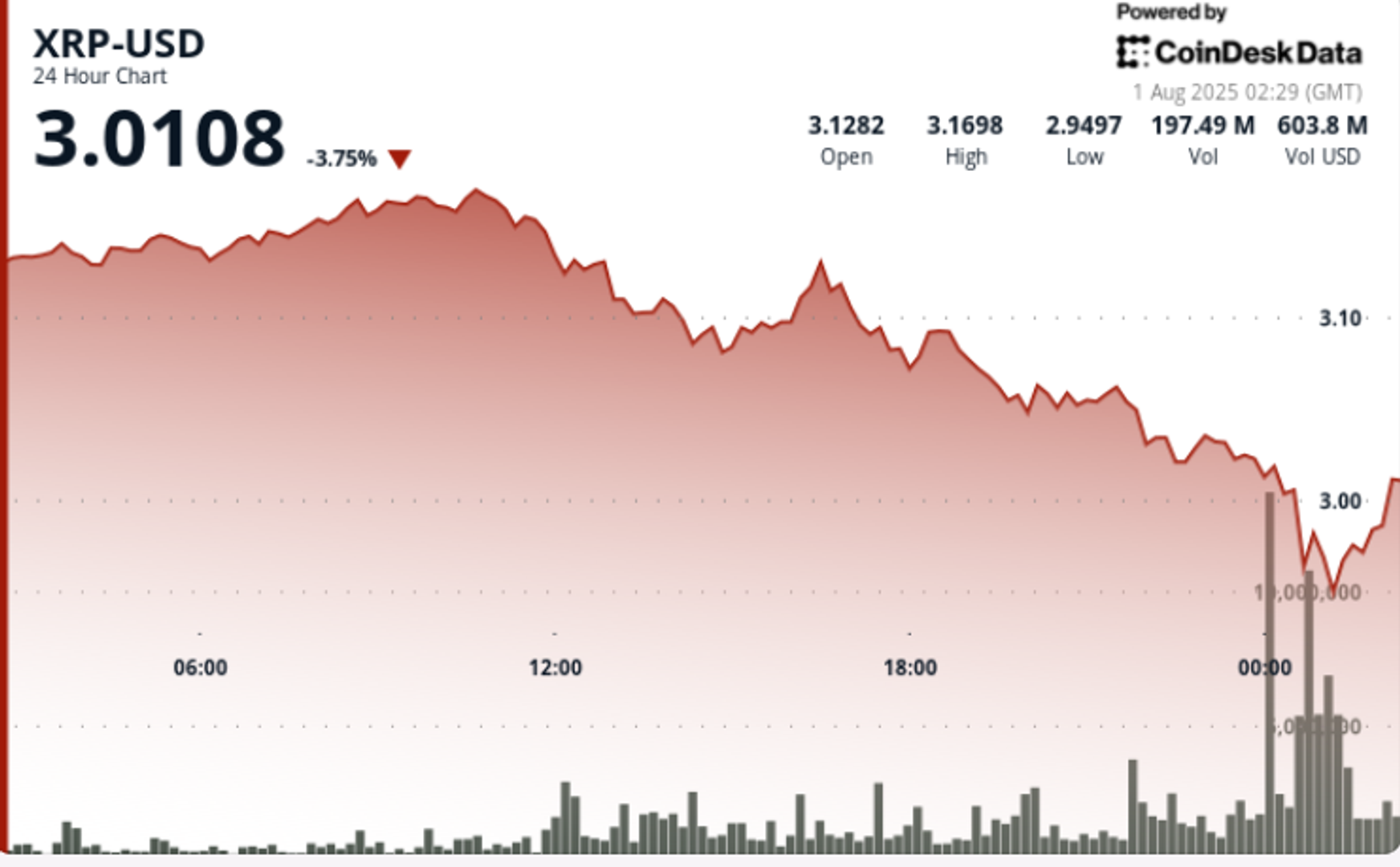

XRP declined 8% over the previous 24 hours, falling from a session excessive of $3.17 to a low of $2.94, as intense promote stress overwhelmed preliminary energy. The sharpest drop occurred throughout the midnight buying and selling window on August 1, when XRP fell 2.7% in a single hour, accompanied by 259.21 million models in quantity—practically 4x its 24-hour common.

Despite the downtrend, accumulation alerts surfaced throughout the restoration section, as XRP rebounded to $2.98. Volume diminished after the preliminary volatility, suggesting that institutional consumers stepped in to soak up extra provide close to key help zones.

News Background

Whale exercise surrounding XRP continues to ship blended alerts. On one hand, massive holders have liquidated roughly $28 million price of XRP every day over a trailing 90-day interval, in accordance with on-chain knowledge. This development highlights persistent distribution amongst institutional and early holders.

At the identical time, over 310 million XRP tokens—valued at practically $1 billion—have been amassed throughout the current correction section, as trade balances fell sharply, signaling sustained capital influx.

Adding to the cross-currents, Maxwell Stein, Director of Digital Assets at BlackRock, confirmed participation at Ripple’s Swell 2025 convention, hinting at rising institutional alignment regardless of current value stress.

Price Action Summary

• High: $3.17 (10:00 UTC, July 31)

• Low: $2.94 (00:00 UTC, August 1)

• 24h Change: -8%

• Hourly Low Point: $3.02 → $2.94 (Midnight drop)

• Volume Surge: 259.21M models throughout correction vs. 64.89M common

• Closing Price: $2.98 (marginal restoration into session shut)

XRP’s closing value close to $2.98 represents a minor restoration off session lows, however nonetheless alerts broader structural weak spot. Short-term sentiment stays fragile amid liquidation flows and technical breakdowns under the $3.00 threshold.

Technical Analysis

The $2.94 help zone held agency throughout a number of intraday exams, bolstered by aggressive dip-buying that allowed costs to reclaim $2.98 by session finish. Resistance stays overhead at $3.02–$3.05, with continued rejection seemingly except spot inflows choose up.

Momentum indicators stay skewed bearish, although recovering quantity profiles counsel some exhaustion within the sell-off.

What Traders Are Watching

• Whether $2.94–$2.95 holds as structural help within the close to time period

• Signs of renewed whale accumulation or a pause in distribution traits

• BlackRock’s positioning forward of Ripple Swell 2025 and its implications for future XRP ETF-related narratives

• Reaction on the $3.00–$3.05 resistance band, which beforehand marked key distribution ranges