Now Reading: XRP Volatility Spikes With $105M in Longs Liquidated Amid ETF Jitters

-

01

XRP Volatility Spikes With $105M in Longs Liquidated Amid ETF Jitters

XRP Volatility Spikes With $105M in Longs Liquidated Amid ETF Jitters

What to Know

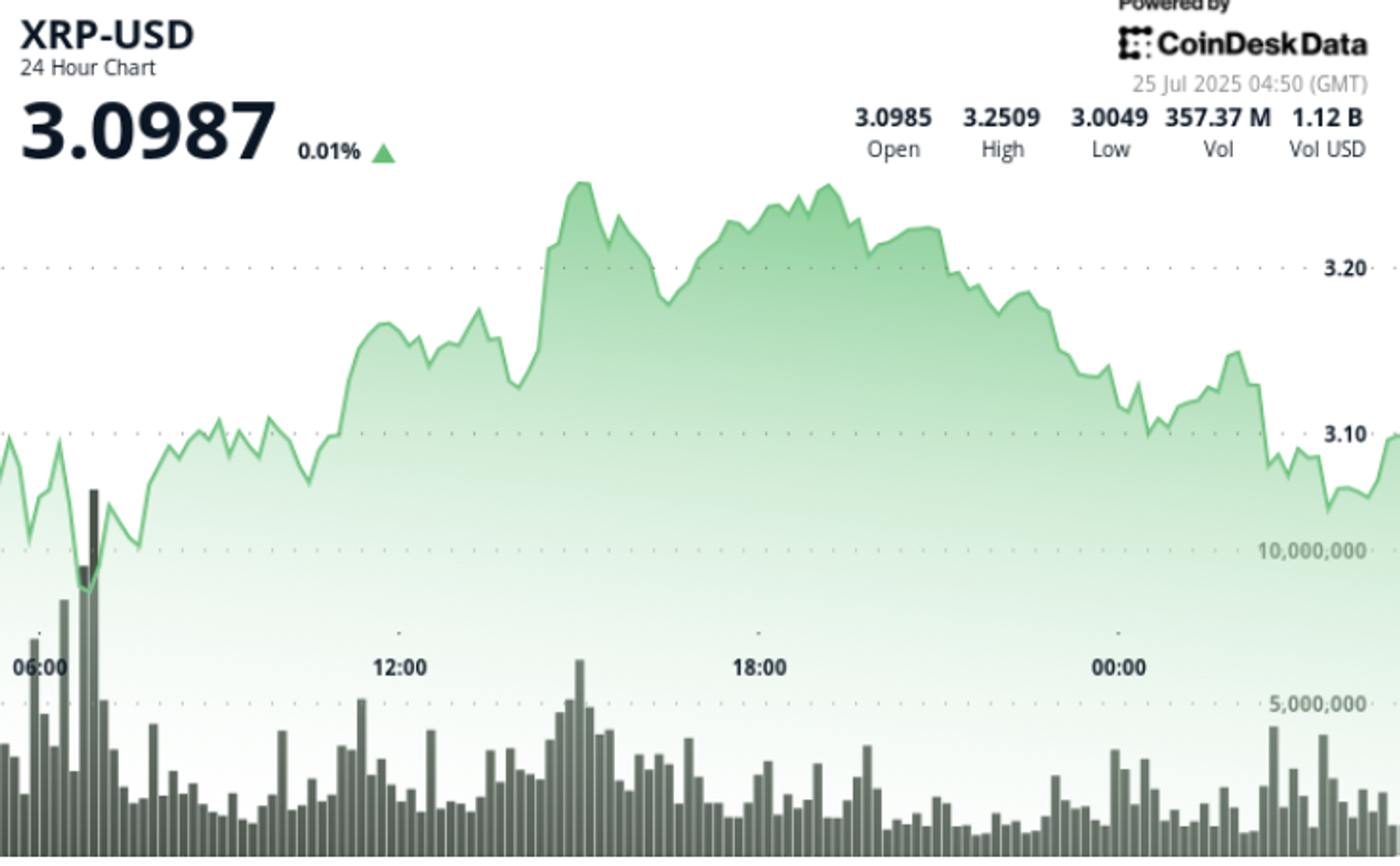

XRP posted sharp losses through the July 24–25 session, dropping 8% because the token traded in a $0.30 vary from $2.96 to $3.26.

An early session rally fizzled after profit-taking intensified close to the resistance degree, whereas a sudden liquidation wave worn out greater than $100 million in lengthy positions.

Despite the selloff, key assist at $3.06–$3.10 held by repeated checks, with late-session worth motion exhibiting indicators of potential stabilization.

Nature’s Miracle and Brazil’s VERT made headlines with new XRP-based methods, however institutional sellers dominated the tape amid fears that ETF approvals could face delays.

News Background

• XRP traded in a 7.85% vary between $2.96 and $3.26 over 24 hours beginning July 24 at 05:00.

• Coinglass information confirmed over $18 billion in complete crypto liquidations through the session.

• XRP lengthy liquidations topped $105 million, contributing to speedy declines.

• Nature’s Miracle introduced a $20 million XRP treasury plan.

• Brazil-based VERT deployed a $130 million blockchain resolution constructed on the XRP Ledger.

Price Action Summary

The session opened at $3.13 and noticed a pointy drop to $2.96, adopted by a bounce to a $3.26 excessive at 15:00 on 175.94 million quantity — greater than double the typical. However, resistance at $3.24–$3.26 capped positive aspects. Price collapsed once more late in the session, dropping to $3.05 through the 03:00–04:00 window on a 6.2 million quantity spike, seemingly resulting from compelled promoting or liquidation flows. XRP recovered modestly to shut at $3.08.

Technical Analysis

• Trading vary of $0.30 between $2.96 low and $3.26 excessive.

• Heavy resistance confirmed at $3.24–$3.26 after rejection submit 15:00 rally.

• Critical assist at $3.06–$3.10 examined repeatedly with volume-backed bounces.

• Final hour reveals breakdown to $3.05 earlier than reclaiming $3.08 — a attainable bullish reversal sign.

• Liquidation-driven volatility suggests elevated danger, however agency bid zones provide short-term construction.

What Traders Are Watching

• Whether XRP can maintain the $3.06–$3.10 zone into the following session.

• Impact of additional ETF-related developments from U.S. regulators.

• Signs of institutional reentry or renewed retail participation above $3.15.

• Broader crypto market stability following multi-billion-dollar liquidations.